Tag: widow

Resilience – financial, emotional, and in the form of family and community support – was sorely tested when COVID-19 turned lives upside down. In a study of workers and retirees 50 and older, the people who lived alone or with extended family struggled the most in the first year of COVID to make the financia…

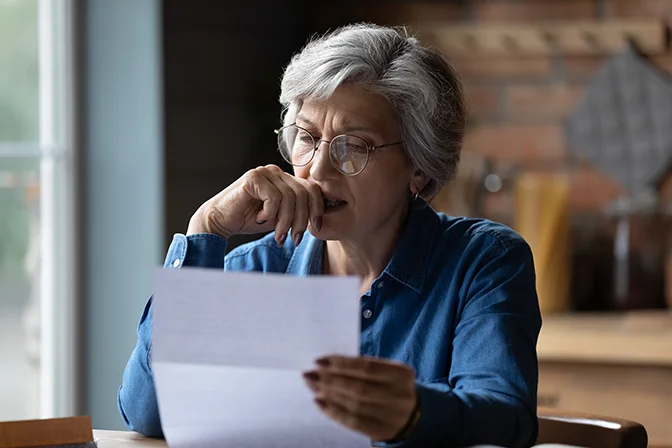

Resourceful retirees usually weather the financial surprises that come their way. But a handful of unexpected health events can really hurt. The death of a spouse is at the top of the list. Net worth drops by more than $30,000 over a couple of years as retirees pay for the extraordinary medical and other expenses…