Tag: retirement

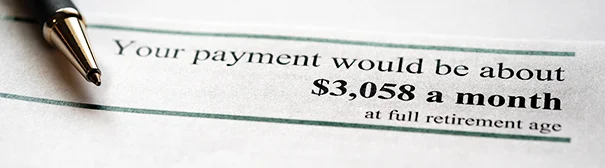

In 1983, Congress introduced gradual increases in the eligibility age for full Social Security benefits from 65 to 67. The increases, starting in 2000 and continuing today, have meant larger reductions in the monthly checks for people who sign up for their benefits early. This was a major cut to Social Security benefits, and it…

U.S. retirement preparedness can best be described as mediocre: about half of workers are not saving enough money to continue their current standard of living once they retire. Judging by a dozen blogs that attracted the most web traffic in the third quarter, our readers understand the importance of the issue. Some felt strongly that…