Tag: retirement savings

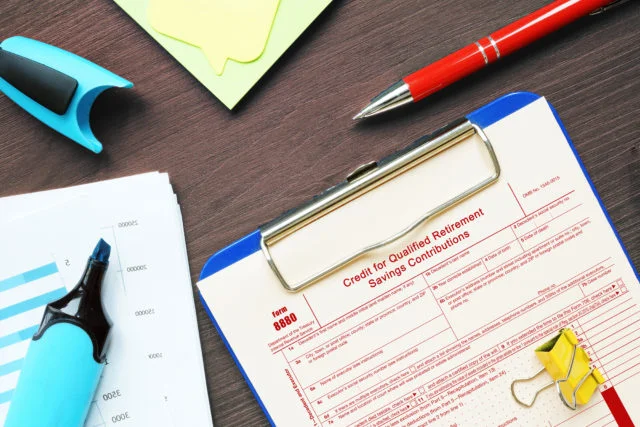

At any given time, only about half of U.S. private sector workers are covered by an employer-sponsored retirement plan, and few workers save without one. The coverage gap, which undermines the retirement security of the nation’s workers, is driven by a lack of coverage among small employers…

Working women have clearly made progress since the 1970s, led by the boomers who streamed into the labor force. They are better educated today, and their pay has been rising relative to men’s. But women continue to contend with lower pay and interruptions in their work histories and premature retirements to care for children or…