Tag: retirement planning

While COVID was raging, the jump in house prices and a rising stock market were dramatically improving U.S. workers’ retirement finances. But the news is not quite as good as it appears, because the increase in house prices in 2020 through 2022, which continues today, was the largest single reason for the improvement. Yes, Americans…

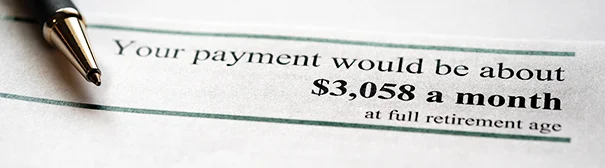

In our high-tech world, virtually any transaction or communication can be executed online. Yet, despite the range of services that Social Security offers on its website, two-thirds of older Americans thinking about retiring or planning to start up their benefits speak directly to someone at the agency, either by phone or at a field office,…