Tag: retired

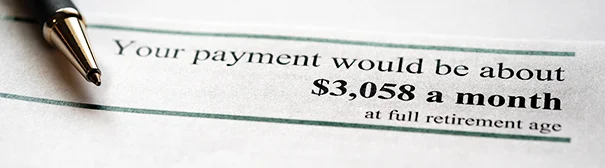

The option to start Social Security benefits at any age from 62 to 70 – with an actuarial adjustment – is a key feature of the program. However, the adjustments – reductions in the monthly benefit for claiming early and increases for waiting – are decades old and do not reflect improvements in longevity or…

In the second half of 2020, the number of retired homeowners who fell behind on their mortgage payments doubled to about 1 million per month. By July of this year, it had dropped to 680,000 retirees. The federal Consumer Financial Protection Bureau (CFPB), which issued the report on homeowners over age 65, said about 12…