Tag: expectations

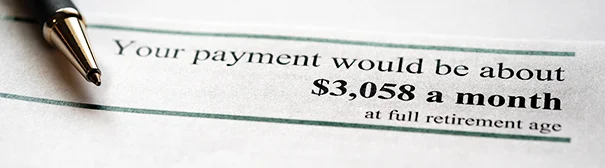

The U.S. Social Security Administration reported a few years ago that half of retirees get at least half of their income from their monthly checks. For lower-income retirees, the benefits constitute almost all of their income. Yet Americans have only a vague understanding of how this crucial program works – one of many obstacles on…

For most of the 20th century, life expectancy was on the rise. Yet older Americans were retiring at younger and younger ages. That changed in the 1990s. Life expectancy continued to rise, but retirement ages started increasing too. Many significant developments are behind the dramatic shift in retirement habits, including the decline of private-sector pensions,…