Tag: couples

Imagine a married couple. Both work, and their earnings are identical. But one spouse’s employer is matching every dollar of her 401(k) contributions up to a cap. The other spouse’s 401(k) match is only 50 percent. They could increase how much they are saving for retirement by contributing first to the 401(k) with the fu…

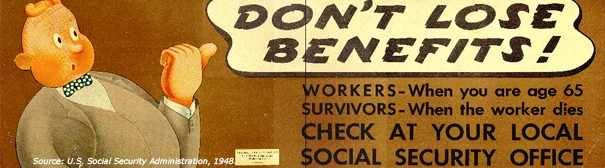

A majority of workers do not know a crucial piece of information about their retirement: how much married couples can expect to receive from Social Security. The program will one day be the most important source of income for millions of Americans. But they showed their lack of understanding of how benefits work in a…