Tag: coronavirus

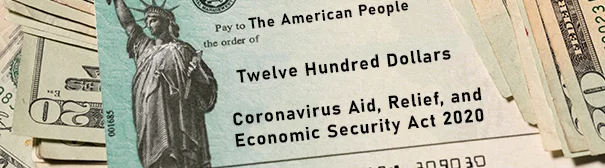

In COVID’s early months, millions of workers’ incomes dried up as the unemployment rate skyrocketed. But older Americans were somewhat shielded from the downturn. That’s because they either are over 62 and on Social Security or receive federal disability benefits every month at higher rates than young adults. And just like everybody else, they got…

In the pandemic’s early days, the unraveling of economic life was breathtaking. Some 3.3 million Americans filed for jobless benefits in the second week of March 2020. A record 6.6 million joined them the following week. By April, government checks were starting to land in workers’ bank accounts, bringing the urgent relief Congress intended. T…