Tag: Coronavirus Aid

In the pandemic’s early days, the unraveling of economic life was breathtaking. Some 3.3 million Americans filed for jobless benefits in the second week of March 2020. A record 6.6 million joined them the following week. By April, government checks were starting to land in workers’ bank accounts, bringing the urgent relief Congress intended. T…

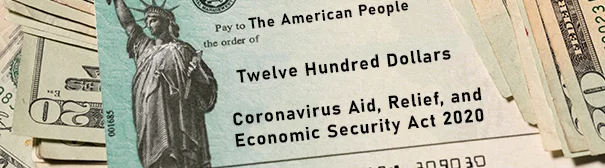

As the pandemic was sinking into our collective consciousness a year ago, Congress, fearing economic calamity, allowed Americans to temporarily halt their mortgage and student loan payments. By the end of October – seven months after President Trump signed the Coronavirus Aid, Relief, and Economic Security (CARES) Act – Americans had postponed some $43 billion…