Tag: 401k

Engaging Retirement Clearinghouse should markedly reduce leakages and increase saving. Rejoice! Vanguard has hired Retirement Clearinghouse LLC to automatically transfer small balances from one 401(k) plan to another. This is a win for Vanguard and its customers, for Retirement Clearinghouse, which has been working on this project for many years, and for the retirement system…

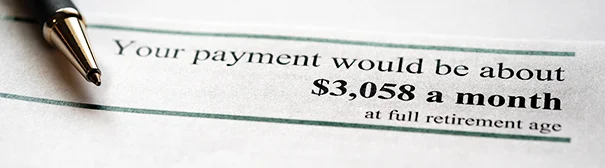

U.S. retirement preparedness can best be described as mediocre: about half of workers are not saving enough money to continue their current standard of living once they retire. Judging by a dozen blogs that attracted the most web traffic in the third quarter, our readers understand the importance of the issue. Some felt strongly that…