Tag: 2008 financial crisis

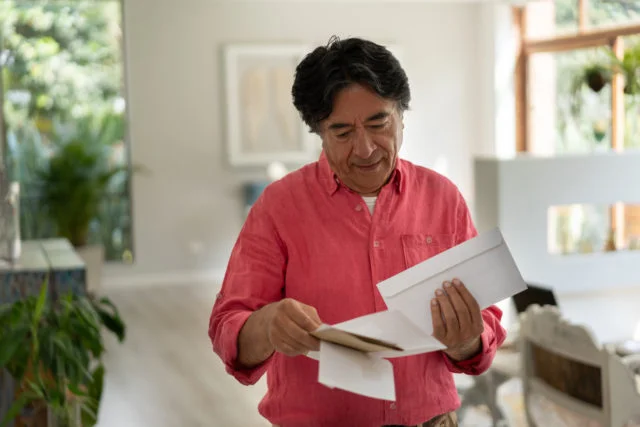

The housing market collapse more than a decade ago inflicted a lot of financial damage on baby boomers nearing retirement. But a new study finds that some have been trying to make up for lost time by rapidly reducing their mortgage debt. Since the Great Recession, the boomers who were born in the 1950s –…