Widows Face More Financial Adversity

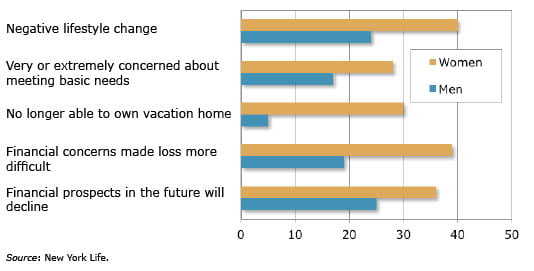

Two times more widows than widowers say their spouse’s death carried significant negative financial consequences during the first year after their loss.

This sharp contrast recurred in numerous financial questions recently posed to widows and widowers by New York Life. The contrast also seemed to persist across various income levels, in questions revolving around both essential needs and luxuries. Here’s a sampling of answers given by nearly 900 Americans whose spouses have died sometime in the past decade:

Their answers beg the question: Why the divergence?

One reason is certainly that two-thirds of the widows surveyed reported their income was under $35,000, while a majority of the widowers earned more than that. Adults over age 18 were canvassed, so working women’s lower earnings no doubt contributed to the income and lifestyle disparities.

Pension survivor policies also play a role, since two out of three of the people surveyed were over age 65.

Consider Social Security. If the person who died was receiving the larger of the two Social Security checks coming into an older couple’s house, the surviving spouse will now receive that larger benefit. But the death of a spouse also reduces the household’s Social Security checks every month from two to one. This happens both to newly widowed men and women, but the women, who typically live longer than men and tend to be younger than their husbands, are more often the ones who must adjust to paying for the fixed household expenses with a single check.

Widows may also lose out under defined benefit (DB) pension plans for two reasons: because men historically were somewhat more likely to have a DB pension, and because women usually out-live their husbands. A man’s full pension will continue if his wife dies first. But if he dies first, the surviving wife’s pension may shrink dramatically.

Under federal law, the default survivor benefit in a DB plan must equal at least half of the worker’s benefit; the worker and his spouse can change it only if they both agree. But if the couple accepts the default, “the benefit might be $1,300 a month while your spouse is alive. However, when he dies, your benefit would be $650 a month for as long as you live,” warns the Women’s Institute for a Secure Retirement.

Women should anticipate and plan for these financial risks.

Comments are closed.

Thank you for writing about this very important issue. A husband’s death catches many widow’s unprepared for the financial loss that accompanies the loss of a life partner. A widow often sacrifices the luxury of just being able to grieve.

I would encourage couples to take active steps, together, to think and plan for the longevity of both parties. Both of you have to make good decisions to make your funds last throughout your joint lives. At the same time, it would be prudent to take steps to help the survivor remain financially secure.

Develop a careful plan that considers joint and survivor annuity options, deploying the equity in your home, and other assets you hold. You will be glad you did.

Another issue is that there are many people that do not have any meaningful term life insurance. It is very unfortunate, but even a modest policy of $200,000 to $300,000 could make a big difference to a widow trying to regroup and move forward with her life. BTW, I do not sell life insurance, but encourage all of my clients to include it in their overall financial plan.

I do know this from personal experience – after my dad died – my mom was, and continued to be, wary of all investments through fear and lack of knowledge and understanding.

If she would have been better informed – we might have done better.

Thank you, very well explained.

Preferably, couples should meet with their planning team to create a “Retirement Income and Estate Plan” that addresses theses and other issues. With a major goal of income (salary) replacement from the working years to becoming “retired,” as well as income planning for the surviving spouse. And I can’t stress enough about beneficiary planning for couples; double check all of your accounts!

But, widows (or widowers) should meet with their team even more urgently. They must plan for maximizing income that would index for inflation to pay for needed expenses into the future.

An items checklist:

– guarantee income for life for “needed” expenses (indexed for inflation),

– have an emergency account,

– use other assets for “optional” expenses,

– address future healthcare costs,

– address possible nursing home costs,

– address any tax problems, (income, Social Security, capital, state, death, etc.),

– change and update all beneficiary planning

– change and update all legal documents

– pre-pay your funeral and burial services, (make sure its portable & Medicaid friendly),

– lastly, check for any “unclaimed property” owed to you or your late spouse in any state lived or worked.

I’m sure there are some other items, but that’s something to start with.

Hopefully, working with a good team of advisers, people can have a “positive” lifestyle change after their loved one passes. Because life goes on, and so do we.

Preferably, couples should meet with their planning team to create a “Retirement Income and Estate Plan” that addresses theses and other issues. With a major goal of income (salary) replacement from the working years to becoming “retired,” as well as income planning for the surviving spouse. And I can’t stress enough about beneficiary planning for couples; double check all of your accounts!

But, widows (or widowers) should meet with their team even more urgently. They must plan for maximizing income that would index for inflation to pay for needed expenses into the future.

An items checklist:

-guarantee income for life for “needed” expenses (indexed for inflation),

-have an emergency account,

-use other assets for “optional” expenses,

-address future healthcare costs,

-address possible nursing home costs,

-address any tax problems, (income, Social Security, capital, state, death, etc.),

-change and update all beneficiary planning

-change and update all legal documents

-pre-pay your funeral and burial services, (make sure its portable & Medicaid friendly),

-lastly, check for any “unclaimed property” owed to you or your late spouse in any state lived or worked.

I’m sure there are some other items, but that’s something to start with.

Hopefully, working with a good team of advisers, people can have a “positive” lifestyle change after their loved one passes. Because life goes on, and so do we.

Thanks for sharing. Widows definitely need to be motivated to get their affairs in order.