Video: Retirement Prep 101

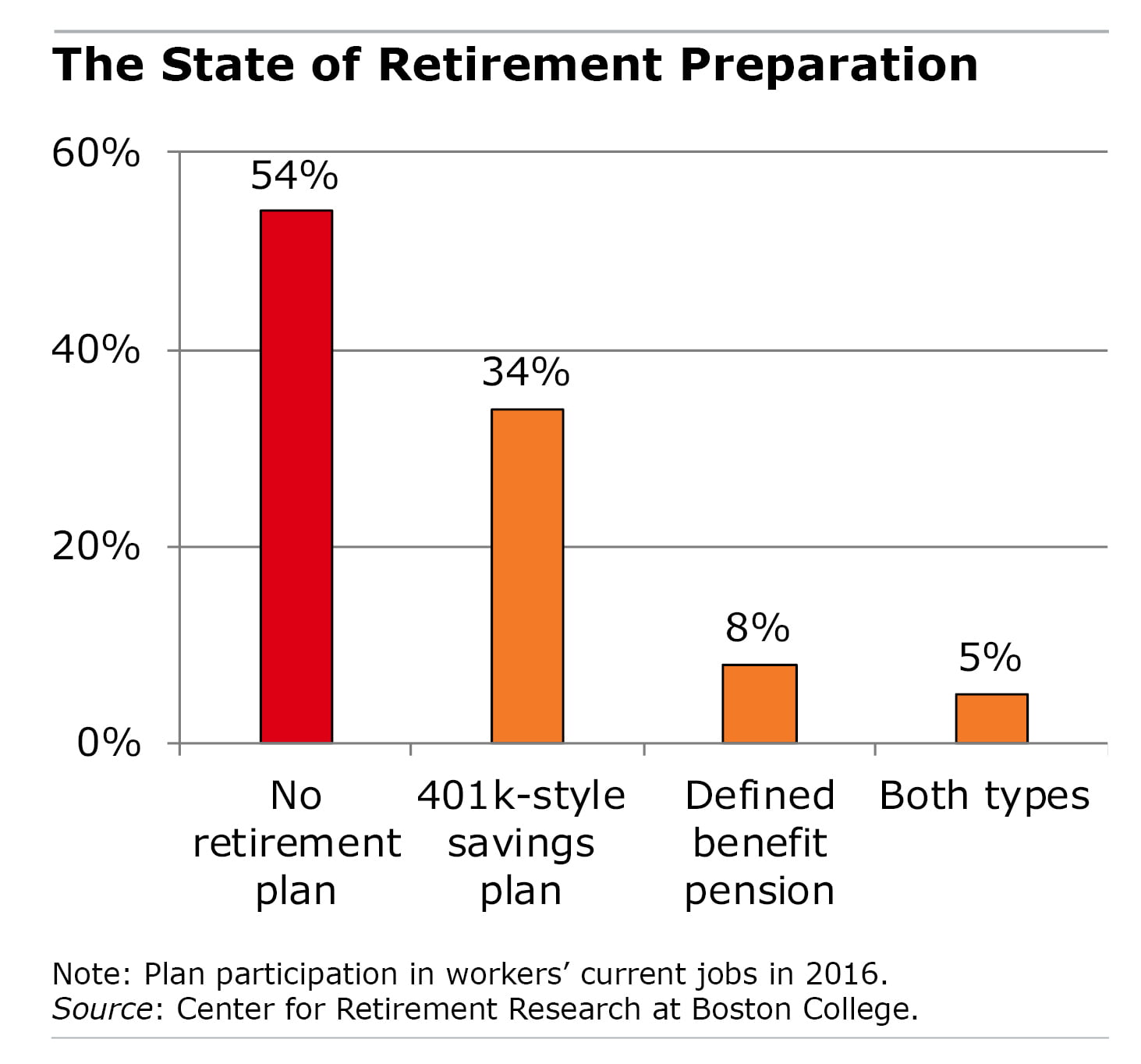

Half of the workers who have an employer retirement plan haven’t saved enough to ensure they can retire comfortably.

This 17-minute video might be just the ticket for them.

Kevin Bracker, a finance professor at Pittsburg State University in Kansas, presents a solid retirement strategy to workers with limited resources who need to get smart about saving and investing.

While not exactly a lively speaker, Bracker explains the most important concepts clearly – why starting to save early is important, why index funds are often better than actively managed investments, the difference between Roth and traditional IRAs, etc.

Some of his figures are somewhat different than the data generated by the Center for Retirement Research, which sponsors this blog. But both agree on this: the retirement outlook is worrisome.

Some of his figures are somewhat different than the data generated by the Center for Retirement Research, which sponsors this blog. But both agree on this: the retirement outlook is worrisome.

The Center estimates that the typical baby boomer household who has an employer 401(k) and is approaching retirement age has only $135,000 in its 401(k)s and IRAs combined. That translates to about $600 a month in retirement.

Future generations who follow Bracker’s basic rules should be better off when they get old.

Squared Away writer Kim Blanton invites you to follow us on Twitter @SquaredAwayBC. To stay current on our blog, please join our free email list. You’ll receive just one email each week – with links to the two new posts for that week – when you sign up here. This blog is supported by the Center for Retirement Research at Boston College.

Comments are closed.

The real problem is they do teach basic finance and investment in high school or college. I took graduate finance in school and rode the train for 10 years with Wall Street people. No one really talked, all they did was read financial papers every day. So I did for 10 years and understand how to invest easily.

I live in a very rural area- with little opportunity. It does have some advantages…close to nature, cheaper home prices, and 40 acres around the home to the nearest neighbor. I am retired with a defined benefit retirement, Social Security, and an annuity which is guaranteed for life. My wife has a defined benefit retirement and her own Social Security from work. Our yearly income is $85k from this. We have no debts whatsoever. We also have around $350k in savings. It is the best that we could do. We are 68. The retirement plan comes with good medical insurance too. I share this so others can compare for their own edification or benefit.

I believe that most young people aren’t exposed to financial education, thus have little understanding of how much they will need to save. The best way to save the significant amounts needed is to begin early, and let compound interest do its magic. An additional step is to always save at least as much as will get the full match on any 401k plan, and to increase your saving as your salary increases.

Isn’t it true that one in five people are illiterate or “functionally illiterate.” If that is the case, then a corollary would be they are mathematically illiterate.(There is a fancy word for this but I can’t remember)

If people can’t add or subtract and when it comes to compound interest…multiply! Then how can they be expected to invest?

This is why the defined benefit came into being. The average American needs money for food shelter and clothing and isn’t worried about tomorrow because they can’t! Then all of a sudden they can’t work anymore because of disability, etc. Welcome to the America of the 21st Century. Intelletuals then wonder why there is despair?

Is this retirement strategy set by the government or is it planned?