Student Loans = No House, No New Car

Here’s what Will Flannigan, 26, would rather do with the $401.58 he pays on his student loans every month.

• Save.

• Buy a house: the mortgage payment on a house he looked at was the same as his rent, but renovating or fixing anything would be unaffordable.

• Replace his 2006 Ford Focus – it’s red but he calls it a “lemon.”

• Buy new clothes – thrift shops are standard.

• Eat dinner out at someplace other than a fast food restaurant.

Flannigan is getting married in August – to a woman who pays about $250 per month for her college loans.

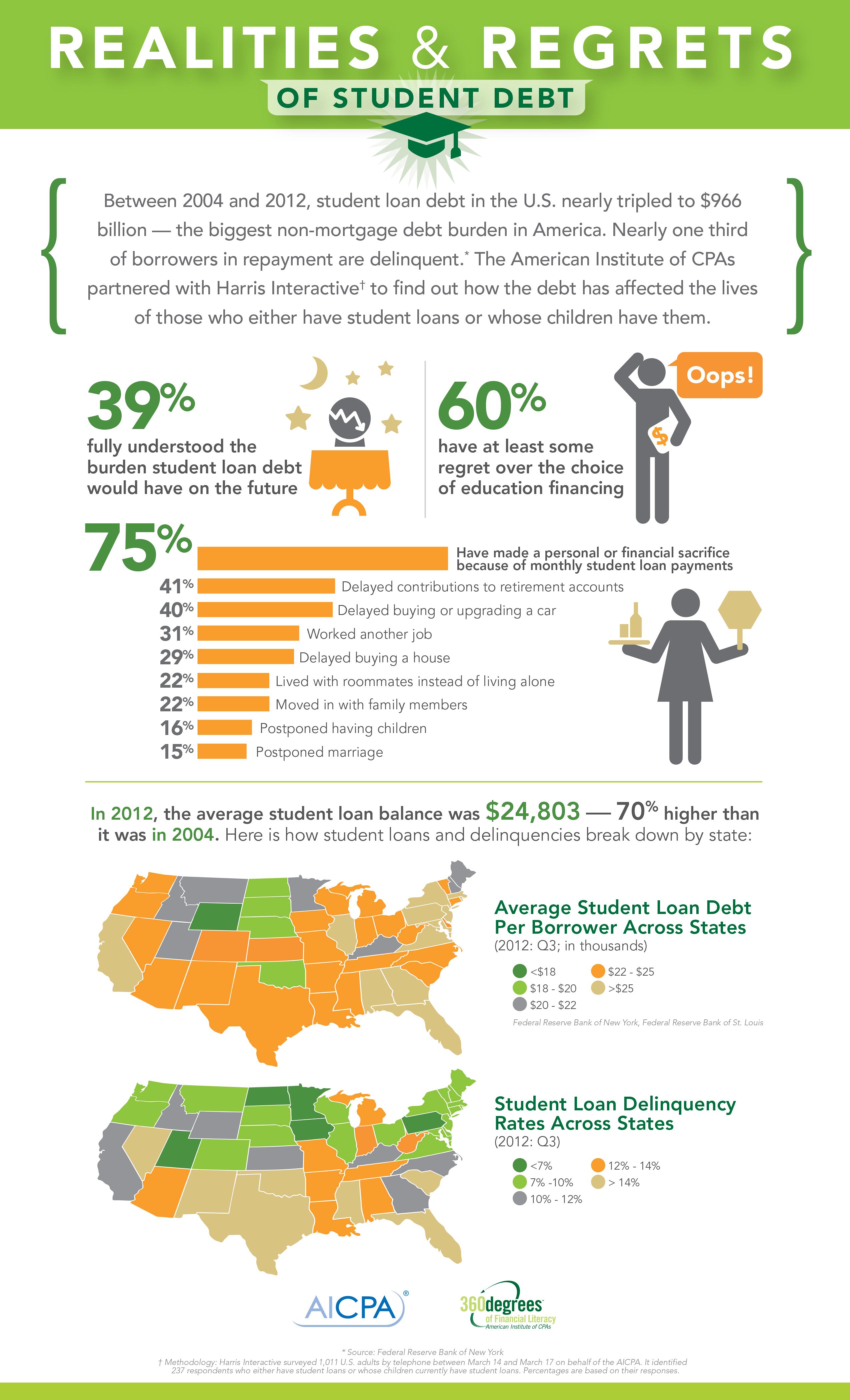

Three out of four people now paying off student debt – whether graduates or their parents – are just like Flannigan: they’re delaying important life goals in order to make their payments, according to a new survey by Harris Interactive sponsored by the American Institute of CPAs (AICPA). About 40 percent also said they have delayed saving for retirement or buying a car, to name just two deferred goals.

This survey, which was random and based on telephone interviews, illustrates the reason behind the growing concern among financial advisers, 20- and 30-somethings, and their parents that paying for a college education has become a burden with financial implications for years, even decades.

“It’s indentured servitude – that’s what it is,” said Flannigan, a Kent State graduate (2010), whose loan payments equal one-quarter of his salary as the online editor of Farm and Dairy, in Salem, Ohio, near Youngstown. Payoff horizon for his $62,000 loans: more than 25 years, according to his loan documents, he said.

The Federal Reserve Bank of New York reported data in April that confirms student debt is affecting homeownership, as the AICPA survey also found. People with more education are more likely to own homes. But for the first time in more than a decade, the Fed said, 30 year olds without any student loans are more likely to own homes – or borrow money to buy cars – than those with a history of borrowing for college, who are more educated.

Perhaps the biggest hit to Will Flannigan may be to his aspirations. He would love to pursue his dream of being a journalist in a city like Manhattan, where there’s more opportunity than in his small town. But he feels strongly that he can’t take an early-career risk, with a loan payment that comes around every month. (In 2011, while unemployed, he asked the bank that gave him a private student loan to defer his payments; the bank told him that he had to have a job to obtain a deferral, he said.)

For many graduates, student loan payments hit them like the proverbial Mack truck: 61 percent surveyed did not understand the ramifications when they took on the debt, according to the AICPA poll. Harris interviewed 237 respondents who were either graduates or parents making payments on their children’s behalf.

“I see it all the time with my clients,” said Ernie Almonte, a Rhode Island CPA and chair of the Financial Literacy Commission for AICPA. The average student loan debt for all U.S. graduates in 2012 was about $29,000, according to finaid.org, which tracks the data, but some students Almonte talks to have $100,000 or more in loans.

“That’s a mortgage without a house. It can have a major negative effect on their lifestyle when they get out of college,” he said. To prevent this situation, he cautions parents and their future college students to remember that entering college isn’t just a life choice – it’s a major financial decision. He’s a big proponent of community college for two years to reduce the total cost of a four-year education.

For prior blog posts about student debt, read “Frustrations of Managing Student Loans” and “Student Debt Binge: How Will It End?”

You can share this article on Facebook by clicking here.

Comments are closed.

High levels of debt also affect the risk capacity of the individual.

It is unlikely that we will see entrepreneurs out of someone with debt.