Student Loan Payments Linked to 401ks

Student loans or the 401(k)?

Young adults have a tough time finding the money for both. Unless they work for Abbott Laboratories.

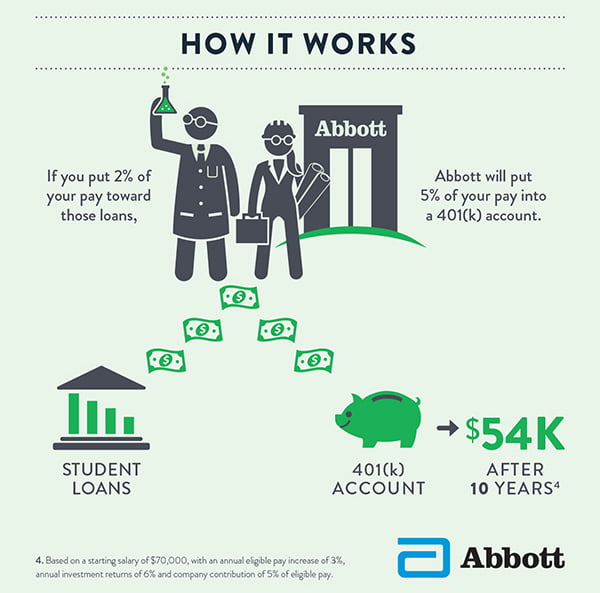

Employees who put at least 2 percent of their income toward student loan payments will qualify for Abbott’s

5 percent contribution to their 401(k) account – without the worker having to put his own money into the 401(k).

From the company’s point of view, it’s an innovative recruitment tool – and it worked for Harvir Humpal, a 2018 biomedical engineering graduate of the California Polytechnic State University in San Luis Obispo. He joined Abbott’s northern California office in February.

Humpal said his student loans weighed on him after graduation. “It’s very empowering that Abbott is willing to tackle an issue that’s near to my heart,” said the 24-year-old, who works on medical devices used in heart transplants.

He estimates he will pay off his $60,000 student loans about four years early and save $7,000 in interest – without completely sacrificing his retirement savings.

As the cost of college continues to rise and U.S. student loan balances hit $1.5 trillion, an increase in the number of private and even government employers offering student loan assistance is a response to the growing financial burden. An Abbott survey found that 87 percent of college students and 2019 graduates want to find an employer offering student loan relief.

The magnitude of the problem “forces us to focus on our employees’ greatest needs and how we, as an employer, can help them,” said Mary Moreland, an Abbott vice president of compensation and benefits.

The company began the program after receiving a special IRS ruling that permits Abbott to give a 401(k) contribution to an employee who makes payments toward student loans, preserving the retirement plan’s tax-exempt status.

Nearly 1,000 people are participating, Moreland said. After a burst of sign-ups following the August rollout, enrollment has increased steadily. All workers who are paying off their own student loans are eligible, including brand new hires. Older workers paying for a child’s education cannot participate.

Humpal said the program is freeing up money for other priorities. He just bought a sporty 2009 Toyota Camry. “In five or so years,” he said, “I might want to buy a house.”

Squared Away writer Kim Blanton invites you to follow us on Twitter @SquaredAwayBC. To stay current on our blog, please join our free email list. You’ll receive just one email each week – with links to the two new posts for that week – when you sign up here. This blog is supported by the Center for Retirement Research at Boston College.

Comments are closed.

This plan is certainly innovative, especially because many early-career employees do not contribute to their 401(k) plans because they need to make student loan payments, and they miss out on free money. However, I would encourage Abbott to think about auto-escalation. Otherwise, these early-career folks would become anchored around 5% of their pay in their 401(k), and that is certainly not enough savings over the long term. Many studies suggest that 20% of pay works well (15% self + 5% match). Abbott’s employees may fall far short in their long-term savings without auto-escalation.