Strange Influences on Financial Decisions

It would be nice to think that careful financial planning is behind the critical decision of when to start collecting Social Security benefits.

But psychological traits – perhaps impatience or one’s fear of losing money – can also affect whether an individual claims his benefits right at age 62 or waits a few years to increase his monthly income from Social Security. A new study reveals another powerful influence that can jeopardize financial security: how a person’s dollar benefits might appear on the printed Social Security statement.

Business professors Suzanne Shu at UCLA and John Payne and Namika Sagara at Duke University tested this on people over age 40, controlling for psychological influences on the research subjects, such as their impatience, loss aversion, and expectations of how long they’ll live.

In the first experiment, some people were shown tables presenting their monthly Social Security benefits for each claiming age from 62 to 70 – this layout highlights the significant benefit increases that come with each year of delay.

A second set of subjects saw more complex tables displaying their total potential benefits accumulated over their entire time in retirement, which depends on both the age they first claimed and on how long they’ll live. This presentation emphasized a different aspect of the decision: the later someone claims and the longer he lives, the more money he’ll receive over many years. Die young, however, and the accumulated benefits are higher for those claiming at 62.

The experiment’s outcome was significant. The cumulative tables “make people want to claim earlier” – six months earlier than people shown the tables with monthly benefits – Shu said during a recent presentation.

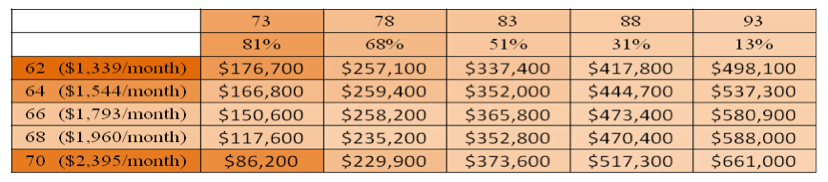

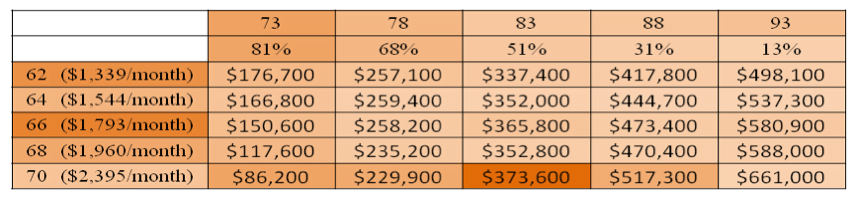

In a second experiment, the researchers used eye-tracking software to identify where the subjects focused their eyes on tables that displayed their potential benefits. These tables, shown below, presented monthly Social Security benefits at various claiming ages in the left-hand column, while total benefits were in a matrix, based on the subject’s claiming age (by row) and how long they might live (by column).

Those who decided to collect benefits early – between ages 62 and 64 – focused on much different figures than those who decided to claim later. The early claimers spent far more time – 13 seconds – studying their monthly benefits at age 62 (shaded dark orange in table below). They also spent more time on their cumulative benefits, if they were to live to just 73. They only glanced at the total benefits they would receive if they live into their 80s or 90s.

as

In contrast, the late claimers focused most intently on their monthly benefits at age 66 – 8.4 seconds – and on their cumulative benefits if they lived to age 83.

“Information presentations do have a big impact on people’s intentions and on how they use information in decisions,” Shu concluded.

These findings may be useful to financial planners or policymakers trying to help people make good financial decisions. The personal lesson here: carefully consider all the options before signing up for your Social Security benefits.

The research reported herein was performed pursuant to a grant from the U.S. Social Security Administration (SSA) funded as part of the Retirement Research Consortium. The opinions and conclusions expressed are solely those of the author(s) and do not represent the opinions or policy of SSA or any agency of the federal government. Neither the United States Government nor any agency thereof, nor any of their employees, makes any warranty, express or implied, or assumes any legal liability or responsibility for the accuracy, completeness, or usefulness of the contents of this report. Reference herein to any specific commercial product, process or service by trade name, trademark, manufacturer, or otherwise does not necessarily constitute or imply endorsement, recommendation or favoring by the United States Government or any agency thereof.

Comments are closed.

Excellent post. Will definitely pass this along to my clients in my newsletter!

People will generally focus on the short-term unless information is presented in a such a way that forces them to think long-term.

I think this explains some of the mortgage bubble. Many people focused on the really low ARM rates and forgot a big payment comes in just a few years.

The long-term thinkers (the “conscientious” to use Angela Duckworth’s term) focused on saving saving for a home and having a 30 year Fixed rate mortgage.

I suspect that many people are misled by the presentation of SSA’s Your Social Security Statement where it says, …if you continue working until… They see the increased monthly income at 70 vs full retirement age vs 62, but think, I don’t want to work until I’m 70, failing to realize that, if they’ve had a long working life, most of that increase is from claiming later rather than working longer.