Retirement Delayed to Pay the Mortgage

Older Americans who are in debt are choosing to delay their retirement, researchers conclude in a new working paper.

In earlier findings released last summer, the researchers, Barbara Butrica and Nadia Karamcheva of the Urban Institute, documented the growing prevalence of borrowing since the late 1990s among adults ages 62 through 69. Median debt levels among those who owe also surged from $19,000 to $32,100, adjusted for inflation – and debts as a share of their assets increased.

Now comes the rest of the story. When the researchers controlled for health, financial assets, home values, and other forms of wealth, as well as spouses’ earnings and other factors that play into decisions about retiring, they found that individuals with debt, especially mortgages, behave differently than those who are debt-free.

Here are their main findings:

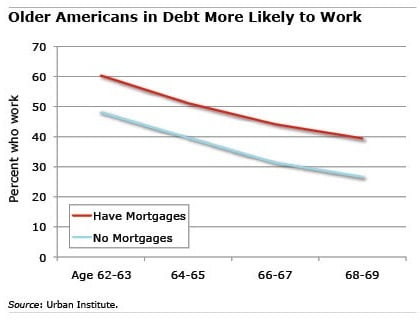

- Nearly half of all people in their 60s with debts continue to work, compared with only one-third of those who have no debt.

- Mortgages seem to have a greater influence on their decisions than credit card bills or other consumer debt. At age 64, for example, more than two-thirds of homeowners with mortgages still work, compared with just over half of homeowners who’ve paid them off.

The researchers contend that rising debt levels are changing the U.S. retirement landscape.

“More than ever,” they said, “retirement security will depend on having enough income and assets to pay for basic living expenses and to service debt.”

Full disclosure: The research cited in this post was funded by a grant from the U.S. Social Security Administration (SSA) through the Retirement Research Consortium, which also funds this blog. The opinions and conclusions expressed are solely those of the blog’s author and do not represent the opinions or policy of SSA or any agency of the federal government.

Comments are closed.

It would be interesting to study the other housing choices people can use to solve the debt problem.

– How many are able to downsize while extinguishing mortgage debt?

– Can they do so and remain in their same community or at least, nearby?

– Is housing so expensive in their area that even downsizing requires relocation?

– To what degree are tighter lending standards hindering downsizing for those who still must carry a mortgage?

Perhaps most important: Will developers and planners recognize the need to provide for affordable senior housing choices? Choices within the general community are needed, not just new tract houses in the suburbs for those 55+.

Yes that would be interesting!

Also, one of my colleagues, an economist, who read about this research wondered whether people with a stronger taste for work are simply more likely to borrow more. Or perhaps there are other reasons for the differences in borrowing levels.

Kim (blog writer)

As to delayed retirement, what about (I’m sure) the many of us in this group who are being pushed out the door because we get laid off, have early retirements whether we want that or not, or get fired and replaced by very young people who are put in our jobs just because we’re getting older ? And, finding a new job is almost ALWAYS on line, many ask either when we graduated from high school, our AGE, or won’t consider us in the pool of candidates. When we do go for an interview, they suspect we might be even older when we do things like dye our hair, etc.? (Many) companies just don’t WANT older workers, so how are we suppose to survive if we have mortgages, etc? I’d like to see a study done of those who lost their jobs, are older and can’t find another one. We’d like to work and are competent to do so, but they still won’t hire older workers…

We’re definitely seeing this in our user base: the boomers were/are more comfortable with debt (they have more of it), so as they move into the retirement phase, the average amount of debt we see per household is rising.

Thankfully, there are employers who view older workers favorably. They can be more loyal, dependable and patient compared to younger, less experienced workers. If you’re eligible for Medicare, not needing an employer health plan may help make you be a more attractive job candidate.

Self-employment is an alternative that some may be able to explore. If one spouse is still in the workplace, or if you’re able to supplement self-employment earnings with Social Security, it may be worth a try. It may even be a more satisfying option.

Being in the over 50 club myself, with still owing a mortgage, it does delay retirement. If we didn’t have one, we could relax and just budget the utilities. But owing on a mortgage, we are faced with making life decisions on whether to keep the home or let it go earlier than paying it off. It can be a very stressful decision because rent is out the roof and the thought of having to move and possibly having to move again if your rent goes up, is what keeps us working.

This is a terrific article and a great example of why I follow this blog. From my observations as a licensed mortgage professional, I can attest to the findings and concur that the days of retiring at a decent age are long gone for most. The point Delores brought up in her comment is key as well; citing that older people in the workplace are often ‘forced’ out, thereby pushing them into retirement sooner.

The truth of the matter is that while I’m sure some employers may practice age-based discrimination, most just higher the younger applicants because they a) have more current technological training and skills or b) require less pay.

The great thing about America is that if no one wants to hire you, there’s almost nothing to stop you from starting your OWN business. Don’t let the workplace dictate your future, take it into your own hands.

And as far as maintaining mortgage debt throughout retirement, I offer a few solutions:

-Downsize your home (sell you current and use the equity as a down payment for a smaller home, thereby lowering your monthly expenses)

-Get a reverse mortgage (not for every situation, but this can allow you to keep your home without making ANY mortgage payments – there’s a lot more to it than that, confer with a pro for more info)

-Go multifamily – Did you know that it is possible to own a multifamily home and live practically for free by renting out the vacant areas?

There ARE options, but people need to reach out and contact their financial and mortgage professionals to get the appropriate game plan together!

This article and the findings are “spot on” with what many of us are facing, particularly after the Great Recession. Many of us were forced to modify our mortgages to stay above water, but this left us with longer term mortgage debt that will still remain long after we turn to worm dust. This is why we have to reinvent what retirement means and why I created a website to promote this concept and profile seniors who have found a fulfilling and satisfying working life in their “retirement.” It’s a new day folks!