Millennial Retirement ‘Discouraging’

Baby boomers have limited time and only a few options to improve their financial prospects when they retire and give up a regular paycheck. Millennials have more time to do something about it.

They should start thinking about it, indicates a study by the Urban Institute’s Richard Johnson, Karen Smith, Damir Cosic, and Claire Xiaozhi Wang.

Their test of a comfortable retirement was set at a 75 percent replacement rate, meaning retirees need 75 cents in monthly income for every dollar earned in their final decade of working. For this analysis, the researchers estimated retirement income at age 70 – an age when most people have already retired – for every individual in the federal data sources used in their analysis.

Their test of a comfortable retirement was set at a 75 percent replacement rate, meaning retirees need 75 cents in monthly income for every dollar earned in their final decade of working. For this analysis, the researchers estimated retirement income at age 70 – an age when most people have already retired – for every individual in the federal data sources used in their analysis.

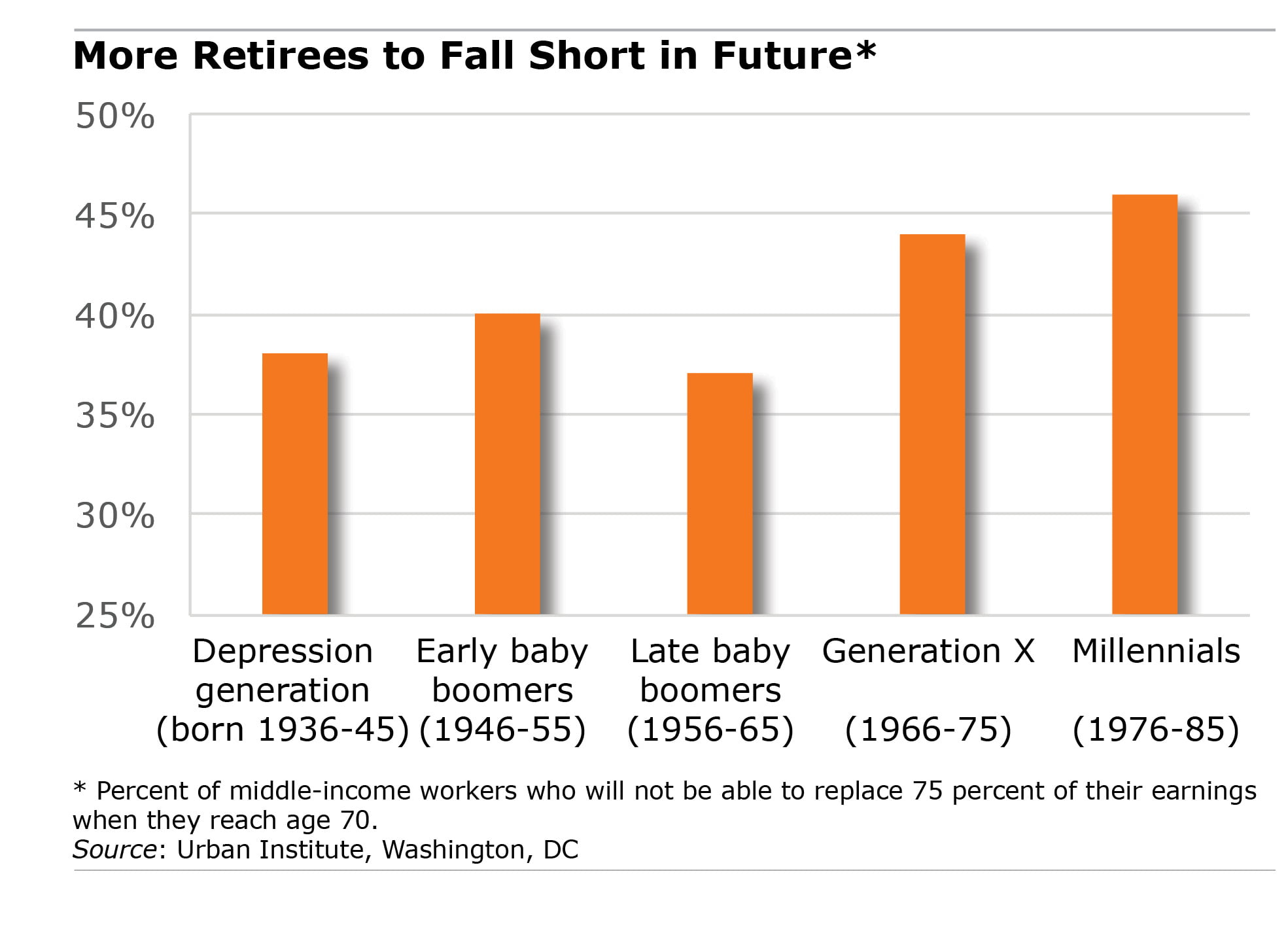

They found that about a third of boomers and boomers’ parents don’t have enough retirement income to make that 75 percent cutoff. Millennnial households will be significantly worse off at age 70: nearly half are at risk.

The prospects for Millennials are “discouraging,” the researchers said.

A new analysis of Millennials’ current and future financial health by the Center for Retirement Research, which sponsors this blog, finds similar results about their retirement, concluding that they are “less well prepared” than older Americans.

To compare each generation’s financial outcomes, the Urban Institute Researchers plugged the myriad factors that determine personal wealth into their model – from marriage and homeownership rates to home equity levels. The analysis hinged on making a lot of difficult assumptions accurately.

One advantage Millennials have is higher rates of college graduation. This could improve their future labor market prospects and make it increasingly easy to save for retirement.

But here’s another concern: the researchers presented the case for the “typical” Millennial. Unfortunately, less-educated, low-income, single or minority Millennials are likely to do even worse.

The research reported herein was performed pursuant to a grant from the U.S. Social Security Administration (SSA) funded as part of the Retirement Research Consortium. The opinions and conclusions expressed are solely those of the author(s) and do not represent the opinions or policy of SSA or any agency of the federal government. Neither the United States Government nor any agency thereof, nor any of their employees, makes any warranty, express or implied, or assumes any legal liability or responsibility for the accuracy, completeness, or usefulness of the contents of this report. Reference herein to any specific commercial product, process or service by trade name, trademark, manufacturer, or otherwise does not necessarily constitute or imply endorsement, recommendation or favoring by the United States Government or any agency thereof.

Comments are closed.

While 75% income replacement may be an appropriate goal for those with average incomes, I think it is way too high for those making twice the average income, or more.

My wife and I are making just over half our pre-retiremnt income and seem to be able to afford what we want (including lots of foreign travel).

I suspect the same is true for most people who made two or three times the average income before retirement.

Agree with William but that’s not the whole story. How you live, your life style, saving habits, how you handle what you have – makes the difference. Had zero when married at 27. Was a ditch digger on a concrete crew. Lived frugally. Invested. Now 74 & millionaire, actually multi-millionaire. So if having stuff now is what they want, they won’t have it later. Pretty basic unless misfortune or fortune happen. Requires thinking ahead and having self-control.