Lifting SALT Deduction Would Help the Rich

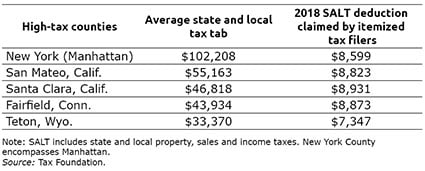

Manhattan residents who itemize their federal tax returns pay an average $102,000 in state and local taxes – more than anywhere else. The second highest tax tabs, nearly $50,000, are in Marin County, the home of musicians and movie stars across the Golden Gate Bridge from San Francisco.

Manhattan residents who itemize their federal tax returns pay an average $102,000 in state and local taxes – more than anywhere else. The second highest tax tabs, nearly $50,000, are in Marin County, the home of musicians and movie stars across the Golden Gate Bridge from San Francisco.

Other enclaves with large bills for property, sales, and income taxes include Falls Church, Virginia, a high-income community outside Washington, D.C., and Teton County, Wyoming, where the super-wealthy buy property on the open range surrounding Yellowstone and Grand Teton National Park.

In 2017, Congress put a $10,000 cap on the amount of state and local taxes – or SALT – that all homeowners could deduct on their federal income tax filings. The proposed reconciliation bill being hashed out in Congress might increase or remove that cap.

The Brookings Institution argued that lifting the cap would “massively favor the rich” at a time U.S. inequality is already at historic levels. There is no shortage of evidence to back that up.

The Brookings Institution argued that lifting the cap would “massively favor the rich” at a time U.S. inequality is already at historic levels. There is no shortage of evidence to back that up.

High-income Americans on both coasts and in major cities like Chicago and Dallas would save thousands of dollars from lifting the cap on SALT deductions. In Santa Clara County, home to Silicon Valley, for example, the average high-income taxpayer who itemized reported that they paid nearly $47,000 in state and local taxes in 2018, according to the bipartisan Tax Foundation’s analysis of IRS data.

But due to the current cap, the IRS permitted county residents to deduct only about $9,000 for their SALT taxes. (The number is slightly below the $10,000 cap because some itemizers take smaller deductions if, for example, they are renters and don’t pay property taxes.)

One proposal gaining currency in the House would increase the cap on deductions from $10,000 to $80,000, as an alternative to eliminating it entirely. Garrett Watson, author of the Tax Foundation report, said that either raising the cap or another idea – limiting the cap to the nation’s top earners – would still mainly benefit the top 5 percent.

But, he added, preserving some type of cap, even if it’s more generous, “will be less regressive than eliminating it altogether, because the folks at the very top – the multimillionaires and billionaires – would still face that curtailed SALT deduction.”

The Tax Policy Center, an affiliate of the Urban Institute and Brookings, estimates that repealing the cap on SALT deductions would increase after-tax income for households earning more than $100,000 by between 1 percent and 2 percent. Families with lower earnings would be unaffected.

The 2017 tax reform, which doubled the standard deduction, also reduced tax burdens for low- and middle-income families who typically don’t itemize, along with some high-income families. The Tax Foundation estimates that raising the standard deduction was effectively a tax cut for nearly 30 million families.

But the reform, which reduced income tax rates across the board and doubled the estate tax exemption, disproportionately benefited high-income families. Their top marginal tax rate fell from 39.6 percent to 37 percent under the 2017 reform.

The $10,000 cap on SALT deductions was one way to limit the 2017 law’s substantial gains for the well-heeled. Now Congress is considering giving that back.

Squared Away writer Kim Blanton invites you to follow us on Twitter @SquaredAwayBC. To stay current on our blog, please join our free email list. You’ll receive just one email each week – with links to the two new posts for that week – when you sign up here. This blog is supported by the Center for Retirement Research at Boston College.

Comments are closed.

It doesn’t require a tremendously high income or possession of tremendously expensive property to exceed $10,000 in state and local taxes, so the arguments for increasing the cap aren’t entirely without merit. However, the federal budget requires substantial spending on the elderly and on defense, and that needs to be paid for. In consideration of this, it seems reasonable to consider deduction limits, regardless of the original motivation for imposing them.

I don’t mind some limits, but this also was designed in my opinion to punish states that provided a safety net. Most of the high-tax states spend more on unemployment benefits, education, health, and other social services.

Nothing wrong with voters choosing high taxes and generous social spending. But they then want to pass the buck to voters in low tax states. But only through a very convoluted logic could one argue that stopping them from passing the buck was “punishing” them?

The state and local tax deduction was a partial giveback for the fact that other federal policies transfer substantial money out of these states, pushing up their taxes.

The most important of these — the federal Medicaid matching percentage, with a base rate of just 50 percent in Massachusetts, New York and California (and Texas) but up to 80 percent in other states.

And in New York, where spending is far above those other states, guess where it disproportionately goes?

So one alternative would be to increase the minimum federal match to 65%.

Interesting, wasn’t aware there was that much disparity in Medicaid cost-sharing. Details matter. Thanks.

In NY, CT and MA, not only the rich pay state and local taxes that are much higher than those in other states. The SALT cap was clearly aimed at states that vote Democrat. It is also true that eliminating the cap would primarily benefit the rich. Upping the limit without eliminating it would balance fairness with the need to keep a progressive tax system.

The voters in NY and CA voted for tax and spend. The trouble is that you need a source of other people’s money, the other people being taxpayers in FL and TX who end up sharing the tab.

Here is another perspective from a California taxpayer. We send more $$’s to the federal government than we get back. The same goes for New York. CA and NY is to KY and as Germany is to poorer countries in the EU. What if we indexed the SALT limit and provided a higher limit to the residents of the “maker” states vs the residents of “taker” states. Then perhaps you can begin to convince that CA residents would not be better off being residents of a sovereign nation.

I just don’t get how the Democrats can demonize the rich on the one hand (“pay your fair share”) and then give them what amounts to a massive tax break.

Look, I think the Government is horribly incompetent when it comes to managing the money they get. So I don’t really care a lot either way. It’s just ‘be consistent’ with your messaging, Dems. It’s not that hard.

Most rich income people always complain about high taxes and even all the wealthy TV personalities on Fox, CNN and NBC, but they will never tell the average listener that the top 10% US earners now take in 47% of all income in the US. It is not the tax but it is the ever increasing income being skewed to the top 1 to 10%.

I don’t think the 2017 SALT limits were created blindly. There was plenty of glee among the anti-taxers that the “elite” coastal areas and cities would bear the brunt of it.

That said, I don’t think it is a good policy to reward high-tax areas by allowing them to shift their burden onto the rest of us.

The current GOP crowd may be brutes, but they’re still a clever lot.

Capping the Salt tax at an arbitrary $10k, not taking into account local taxes, punishes the middle class workers in high tax states. The wealthy find a way around taxes. Wouldn’t it make more sense to base the caps on income? It would be nice if we tried to make our tax system more progressive, as it was meant to be.

If you’ve been fortunate…or very fortunate paying a higher % should be a badge of honor, a civic duty. It’s sad that those that are so fortunate work so hard to keep the system so unfair.