Blacks Invest Less Often

If two people – one black, one white – have good jobs with comparable incomes, the black person would still be less likely to have a taxable investment account, such as a mutual fund, a new study finds.

Numerous reports have shown that black Americans have fewer retirement and other savings accounts, and less money in those accounts than white Americans. But the problem with many of these comparisons is that they lump people together, regardless of how much they earn.

Numerous reports have shown that black Americans have fewer retirement and other savings accounts, and less money in those accounts than white Americans. But the problem with many of these comparisons is that they lump people together, regardless of how much they earn.

A new study by the FINRA Investor Education Foundation looks at one type of account – taxable investment accounts – and controls for income as well as two other characteristics that influence wealth: education and age. The study, using data from a 2012 survey of more than 25,000 U.S. households, found that when everything else is equal, black American households were still 7 percentage points less likely to have taxable investment accounts than white households; and Hispanic households were 4 percentage points less likely to have such taxable accounts than white households.

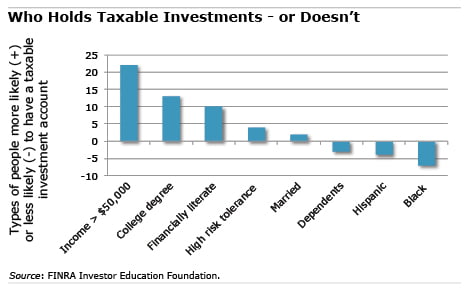

FINRA also identifies other characteristics typical of the one-third of households with a taxable account.

Those with incomes over $50,000 were much more likely to have them – by 22 percentage points – than households with lower incomes. Other contributors include a college degree, greater financial literacy, and a higher tolerance for risk. Couples were also more likely to have a taxable investment account but households with dependents less so.

FINRA added, “Households that own taxable investment accounts are more affluent and financially knowledgeable than households with only retirement accounts, which are in turn more affluent and financially knowledgeable than households without investment accounts.”

Note: 33 percent of U.S. households have taxable investment accounts; 29 percent have only tax-favored retirement accounts; and 38 percent have neither.

To stay current on our Squared Away blog, we invite you to join our free email list. You’ll receive just one email each week – with links to the two new posts for that week – when you sign up here.

Comments are closed.

“Households that own taxable investment accounts are more affluent and financially knowledgeable than households with only retirement accounts, which are in turn more affluent and financially knowledgeable than households without investment accounts.”

This may be demonstrable, but it still grates at me, seeming to suggest that my inability to set aside more than $20k annually is an indicator of financial illiteracy.

[Racism] keeps blacks out of good quality jobs, so where would the income come from to invest?