Black America’s New Retirement Issue

The retirement issues facing black Americans can’t necessarily be lumped together for many reasons – there are high- and low-income blacks, and there are recent immigrants as well as longstanding families. A similar problem arises when treating the U.S. Hispanic-American population or the Asian-American population as a homogenous group.

The retirement issues facing black Americans can’t necessarily be lumped together for many reasons – there are high- and low-income blacks, and there are recent immigrants as well as longstanding families. A similar problem arises when treating the U.S. Hispanic-American population or the Asian-American population as a homogenous group.

Having acknowledged this, however, some recent studies have highlighted the financial challenges particular to each group. For Hispanic-Americans, a major issue is that they live a long time but have low participation in employer retirement plans. For Asian-Americans, extremely high wealth inequality in their working population spills over into retirement inequality.

This blog looks at the recent erosion in homeownership among black Americans since 2000, which threatens to further undermine their retirement security – Generation X is most at risk.

Black workers’ relatively low incomes are probably the first challenge of saving for retirement. In 2015, the typical black family earned $36,898, substantially less than the $63,000 earned by white families, according to the U.S. Census Bureau. Not surprisingly, their participation in employer retirement plans was also lower in a 2009 study, even though white and black Americans have roughly similar access to 401(k) plans through their employers. More than 77 percent of whites with this option save in a 401(k), and only 70 percent of blacks do.

Homeownership is also crucial to building wealth for retirement: the largest asset most older Americans possess is their house. This asset can translate into additional disposable income if the mortgage is paid off. Retirees can also downsize to a smaller home or take out a reverse mortgage loan that doesn’t have to be repaid until the homeowner moves out or dies.

The problem for black Americans is that homeownership is going in the wrong direction.

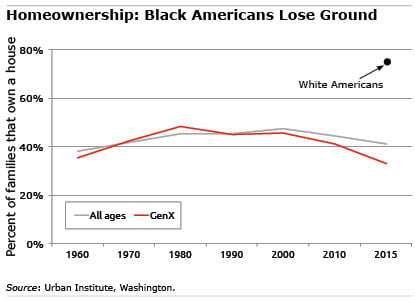

After three decades of rising homeownership in the wake of the Fair Housing Act in 1968, the trend has completely reversed itself, according to a February study by the Urban Institute.

Homeownership rates declined for all Americans after the 2006-2008 housing boom and bust. But research shows that, during the boom, more black than white homebuyers who could’ve qualified for regular mortgages took out risky subprime mortgages. Not surprisingly, black homeowners were hardest hit by foreclosures in the bust. Between 2000 and 2015, the share who own homes dropped from 47.3 percent to 41.2 percent – a low not seen since 1970, the Urban Institute found.

Black Generation Xers are the biggest concern. Now in their 30s and 40s, they are at the prime age for marrying and having children. Yet this age group’s homeownership rate sank more than 12 percentage points, to just 33 percent in 2015, compared with an 8 percentage-point decline for black baby boomers.

Gen-X black Americans, the Urban Institute concluded, are likely to be “the first generation since those born before 1900 to reach retirement age with more renters than homeowners among their community.”

Squared Away writer Kim Blanton invites you to follow us on Twitter @SquaredAwayBC. To stay current on our blog, please join our free email list. You’ll receive just one email each week – with links to the two new posts for that week – when you sign up here.