401(k)s Stall, Post-Auto Enrollment

Seven years after Congress encouraged employers to automatically enroll their workers in the company 401(k), the retirement fix has run out of steam.

Corporate America rushed in to adopt the feature in their 401(k) plans after the Pension Protection Act (PPA) made auto enrollment more attractive by giving employers that used it a safe harbor from non-discrimination rules governing their benefits.

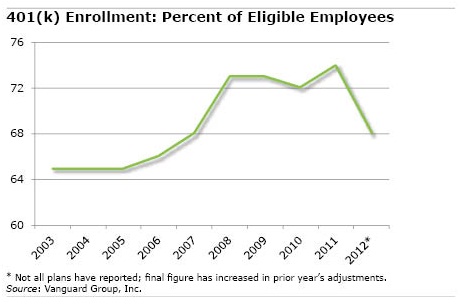

Immediately after the PPA provision became effective in December 2007, employee participation in 401(k)s increased. But since that initial bump, it’s been virtually flat for years.

In 2008, participation increased to 73 percent of all employees in workplaces that offered 401(k)s, up from 68 percent in 2007, according to Vanguard Group Inc.’s new “America Saves 2013” report, which provides a decade of participation rates for its large data base of clients.

Fast forward to 2011: participation was 74 percent. It has barely budged. (Last year, participation was 68 percent, but Vanguard said past experience indicates this figure will rise to roughly the same level when all of its clients turn in their data).

Auto enrollment, based on concepts in behavioral economics, held that employees just needed a nudge to do what was in their own best interest anyway: saving for retirement. If they were automatically enrolled in their 401(k) – and even if they had the ability to opt out if they wanted to – they would remain and save.

The concept clearly works – if it’s adopted. But enough time seems to have passed that we can safely declare that the employers that were going to adopt auto enrollment already have. There’s little reason to expect any great improvement in participation rates in the future.

Perhaps it’s time to ask a new question: Now what?