Retirement Tax Credit for Low Earners

The IRS effectively gives money away to low-income Americans who save for retirement.

Workers meeting the agency’s income requirements can receive a Saver’s Tax Credit equal to as much as half of their total deposits into a 401(k) or IRA. The lower one’s income, the bigger the credit.

The program, which was made permanent in 2006, gives a nice boost to the nation’s lowest-paid workers, who are also most vulnerable in retirement. And not taking advantage of the credit, said Jim Blankenship, a financial planner in New Berlin, Illinois, “is a lot like giving up an employer match for a 401(k).”

Low-income workers do just that, a previous study found: 40 percent decline to participate when their employer offers a 401(k). But the Savers Tax Credit may provide another avenue to this under-covered population.

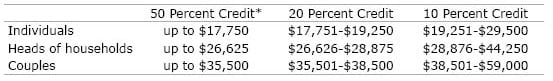

The annual income requirements for the credits, shown in the following table, apply to calendar year 2013 tax filings due April 15.

Since it’s a credit, taxpayers receive either an outright refund or a reduction in their taxes owed. The credits are capped at $1,000 for individuals and heads of households and $2,000 for married couples. But they are in addition to deductions for 401(k) contributions, which lower the taxable incomes of any worker who saves.

Blankenship said he’s encountered people unfamiliar with the credit. He amended several year’s tax returns for one low-income client – a single mother – who was unaware she was entitled to a credit equal to half of her contributions in prior years.

About $1 billion in credits were provided to more than 6 million Americans in the 2010 tax year, the latest year for which data are available, the IRS said. Single taxpayers claimed an average $122 in credits, and the credits averaged $204 for couples and $165 for heads of household.

To read the IRS information and find the form to apply for the credit, click here.

Comments are closed.

The credit is not refundable. The best it can do is lower your tax liability to $0. Look at the instructions for Form 8880. The credit is computed on line 10. It is then compared to the limit on line 11 and the smaller of the 2 amounts is the actual credit. The line 11 limit is income tax due less other credits. If that amount is $0, no credit. For most in the tax brackets eligible for the Savers credit, their tax liability pre credit is minimal.

It’s extremely difficult for low-income people to save. But perhaps some will be persuaded if they can get 20% of the amount saved – or even half of the money- back at tax time. Of course, cash flow is another issue, even if it makes sense financially.

Tom,

We stand corrected. The IRS has just confirmed that while this credit can lower one’s tax bill, it can’t result in a refund.

Thank you!

Kim (blog writer)

The political benefit of sponsoring legislation to create this credit probably far exceeds the real-world value to those who can actually claim it. Looks like another example of Congress patting itself on the back for “doing something.” Bet it passed during an election year.

If they really wanted to help low wage earners save, it would be a refundable credit.

The problems with IRAs are the restrictions from the IRS; not to mention they can freeze your IRA if there is a crisis.

You are saving for retirement using a 401k, great start. There is more you need to know to truly retire as you imagine!