Tag: saving

U.S. inequality can be measured two ways – by wealth or by earnings. Either way, most working Americans are losing out. It’s the 1920s again for the richest 1 percent of Americans, and a recent analysis of the wealth gap illustrates why they’re able to live like the fictional Jay Gatsby, portrayed by Leonardo DiCaprio…

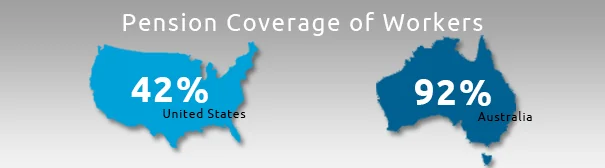

Consider this: 92 percent of Australian workers have 401(k)-style plans, while less than half of Americans have any kind of pension coverage on their current job. This yawning disparity exists, because the Australian government requires employers to contribute 9 percent of each worker’s earnings to a personal account, which participants invest much like a 401(k)…