Tag: retirement

Since you are the best judges of what financial information is most useful, it’s a holiday tradition to feature readers’ favorite articles published during the year. Please spread the word among family and friends about the most popular 2014 blogs, listed below, by “liking” Squared Away’s Facebook page. Readers can also sign up for emails…

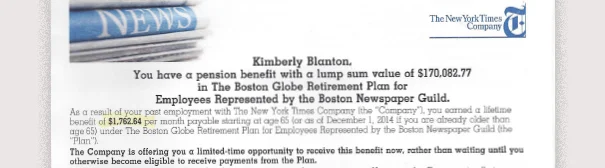

Like many baby boomers, I’ve received an offer from a former employer that’s meant to entice: “The Company is offering you a limited-time opportunity to receive this benefit now, rather than waiting until you otherwise become eligible to receive payments from the Plan.” My 17-year employment as a Boston Globe reporter entitles me to a…