Tag: manage money

Retirement is a joint project for married couples, but remarkably only 43 percent of couples plan for it together. Are wives to blame? Some husbands expressed frustration that their wives don’t engage in planning during a focus group conducted by Hearts & Wallets. One man reported that his wife “is not interested in investing,” and…

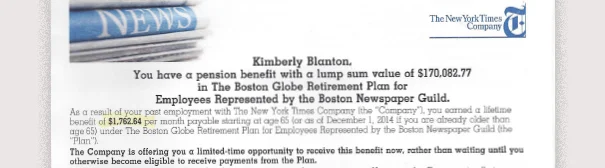

In a divorce, splitting up the pension is trickier than dividing the house. Divorcing couples and their advisers “who aren’t hip to divorce splitting of retirement plan assets often do it improperly,” said Howard Phillips, a Delray Beach, Florida, actuary and author of “Dividing Retirement Plan Assets in a Divorce.” He knows, because he values…