Tag: low income

The fate of the recent expansion of the federal child tax credit is uncertain in the ongoing budget negotiations in Congress. What is clear is that poor and low-income families are putting the increased assistance to good use. Nine out of 10 families earning less than $35,000 are spending the money on one or mor…

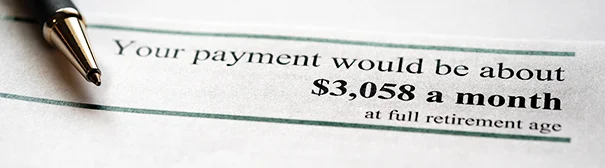

The U.S. Social Security Administration reported a few years ago that half of retirees get at least half of their income from their monthly checks. For lower-income retirees, the benefits constitute almost all of their income. Yet Americans have only a vague understanding of how this crucial program works – one of many obstacles on…