Tag: aging

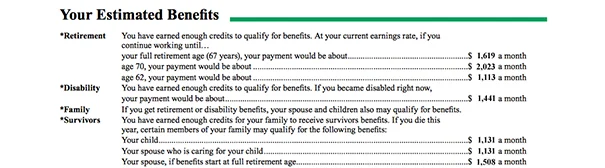

When a Social Security statement comes in the mail, most people do not, as one might suspect, throw it on the pile of envelopes. They actually open it up and read it. But are they absorbing the statements’ detailed estimates of how much money they’ll get from Social Security? RAND researcher Philip Armour tested this…

Nursing homes are usually at the bottom of people’s list of places for their parents. A workable and little-known alternative is available in many states: adult foster care. This PBS video about Oregon’s program features a suburban Portland woman, Carmel Durano, who provides 24-hour care in her home for five elderly people, including her mother…