Work v. Save Options Quantified

One of Americans’ biggest financial challenges is proper planning to ensure that their standard of living doesn’t drop after they retire and the regular paychecks stop.

A new study has practical implications for baby boomers in urgent need of improving their retirement finances: working a few additional years carries a lot more financial punch than a last-ditch effort to save some extra money in a 401(k).

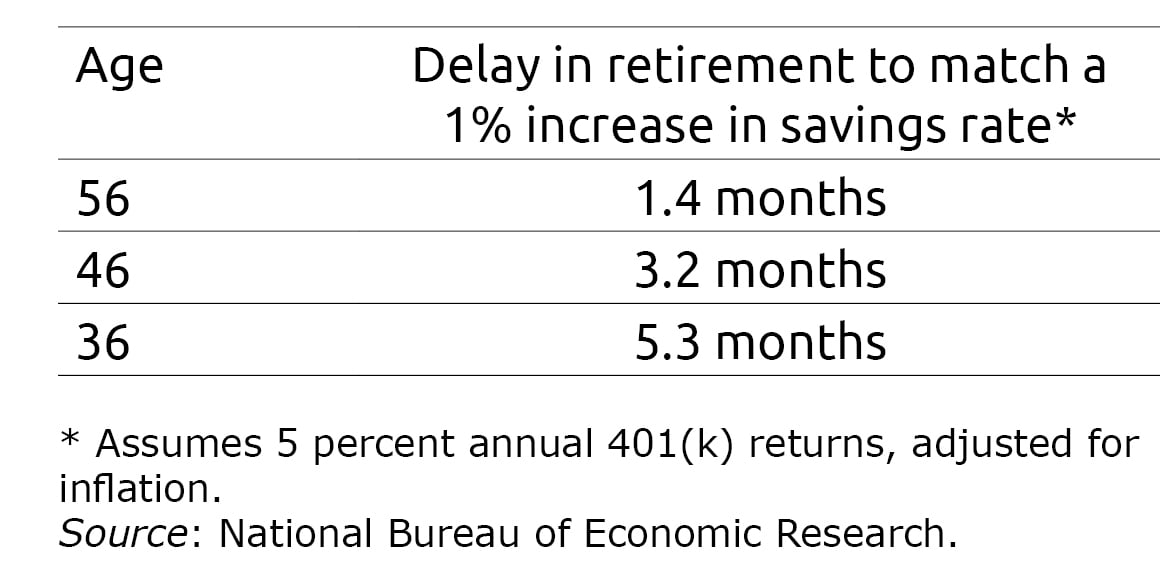

This point is made dramatically in a simple example in the study: if a head of household who is 10 years away from retiring increases his 401(k) contributions from 6 percent to 7 percent of pay (with a 3 percent employer match) for the next decade, he would get no more benefit than if he instead had decided to work just one additional month before retiring.

Of course, this estimate should be taken only as illustrative. To get their retirement finances into shape, many people should plan to work several more years than is typical today. Baby boomers tend to leave the labor force in their early- to mid-60s, even though more than four out of 10 boomers are on a path to a lower retirement standard of living.

The strategy of saving just a little more works better for younger workers, according to researchers Gila Bronshtein at Cornerstone Research, Jason Scott at Financial Engines, John Shoven at Stanford University, and Sita Slavov at George Mason University. For the same 1-point increase in the savings rate, a 36-year-old gets nearly four times more benefit than a 56-year-old, because the 401(k) contributions will be made over several decades and will earn investment returns.

The main reason that working longer is so effective is that Social Security is retirees’ largest income source. Each year of delaying retirement increases the monthly benefit substantially – for example, signing up at age 70, rather than 62, increases it by about 76 percent. Other benefits to retiring later include more time for a 401(k) to grow through investment earnings and fewer years of retirement to pay for.

For the workers who are on the verge of retiring, it’s clear that saving more money is always helpful. But the best option is to try to keep working.

Squared Away writer Kim Blanton invites you to follow us on Twitter @SquaredAwayBC. To stay current on our blog, please join our free email list. You’ll receive just one email each week – with links to the two new posts for that week – when you sign up here.

Comments are closed.

Good research on strategies for making what you did save last longer. http://www.anderson.ucla.edu/faculty-and-research/anderson-review/decumulation

Wish saving for retirement had been stressed when I was younger!

Hi, this is truly eye-opening.

Is there some sort of calculator to figure out different scenarios? The suggestion here is to stay years longer full-time in a position – comparing it with retiring earlier but increasing the retirement contribution by one percent approximately 10 years before actually retiring. How much longer should one work a) part-time – but increase savings?

or b) full-time plus increase savings?

That would be interesting to compare. Thank you.

We simply used a computer spreadsheet and detailed out for ourselves each of those scenarios that you’ve mentioned. The initial spreadsheet was an estimation looking forward those proposed numbers of years. (I still have my original spreadsheets from 1982. It was so simplistic – but, good enough!!) Each year (more often if needed) we’d re-visit and update the spreadsheet, replacing old estimated numbers with actuals, and then tweaking the future estimates as necessary to aim for our target.

As time went on and we could see where our forecast was trending, our choice was clear – full time plus increase savings and retire early.

Talk to a financial adviser. They are the only ones that can tell you specific information for your specific situation. For example: what lifestyle do you want to have in retirement considering cost of healthcare, amount in retirement, how aggressive or not aggressive is your portfolio, stance on leaving money to heirs, do you plan on inheriting money from family, age, age of retirement, do you have pension? The list goes on.

Many websites offer “calculators” but they do not take everything into account. The hard truth is that most people are not saving nearly enough, didn’t start early enough or a combination of both. This should not stop you from talking to a financial adviser and finding out the specifics for your situation. Good luck.

We read similar information many years ago – increasing the savings rate would make a big difference in retirement. When we crunched the numbers decades ago, we calculated that 6% wouldn’t quite get us to where we wanted to be in retirement – to maintain our standard of living. So we bumped our 401(k) savings rate to near 8% for the 1st half of our careers (not enough to adversely impact our lifestyles), then (once our careers were established) we increased our 401(k) savings rate to almost 16% for the 2nd half of our careers. We averaged an 11.4% contribution rate over our entire careers. The hardest part was the commitment and discipline to keep doing it.

Now 8 years into early retirement, that contribution plan seems to have been on-target. Time will tell.

My family gave me a good example for saving and what savings can do for you. I started saving at about age 10 and learned how to invest while working.

Now I am retired with a pension, and my investment income nearly equals the pension, and have worked several years during retirement to add to that savings and my Social Security account.

The retirement work has supercharged my savings, also it has significantly increased my Social Security value.

Hope this gives some readers a few ideas to pass to their children.

Very useful blog, thanks for sharing.

This ignores sequence of returns risk and variance of returns. I’d love to get 5% year in and year out. 5% average, not so sure.