Navigating the Gift Card Thicket

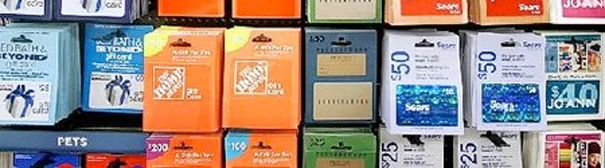

Too many financial products are far too complex. The pre-loaded cards that people give as gifts during the holidays are a multi-billion-dollar example.

When buying these cards, it’s very hard to know what you’re getting and giving. The big things to watch out for are expiration dates and fees. This isn’t easy.

The federal CARD Act of 2009 covers cards issued by retailers for purchases in their stores and cards issued by banks for use in many places. The law bars these gift cards from expiring for five years after their purchase. They must also maintain their full value for a year. But after the first year, the CARD Act permits one fee per month, and a $5 monthly fee can chew up a $25 gift card’s value pretty fast.

It’s difficult to tell the difference between gift cards and prepaid cards, like Wal-Mart’s Bluebird or the RushCard, sold side by side on grocery store racks. But prepaid cards are not regulated at all by federal consumer protection law, while retail and bank cards are, said Christina Tetreault, an attorney for Consumers Union, the non-profit affiliated with Consumer Reports.

State regulations often offer further consumer protections – and add a layer of complexity for consumers. A card that works one way in a state with strong regulations, such as California, may have few protections if you mail it to a relative in Texas.

The following is just a sample of the intricacies of state regulations.

- Very few states (California and Maine are two) ban gift cards from ever expiring or ban all fees (Kentucky and Florida).

- Only a handful of states, including Arkansas, New York, New Jersey, and Washington, restrict so-called “inactivity fees.” Inactivity gradually erodes the card’s value, and the buyer or the person who received the card may not realize it.

- Only a handful of states allow consumers to redeem gift cards for cash with low balances remaining on them. California and Vermont allow card holders to get cash once the value falls below $10. In states where this is not required, the money can effectively evaporate as inactivity fees eat up unused balances. Some stores permit customers to use the remaining balances in other ways, but they’re not always legally required to do so.

- Retailers’ gift cards typically do not charge an activation fee – that makes sense. You buy a $25 gift card at the Gap, and the company wants you to buy $25 worth of blue jeans. But bank-issued cards may charge a fee. Is it really worth $3.95 to give someone a $25 American Express gift card?

- Remember that if the retailer goes out of business, or if your family member loses his gift card, he may be out of luck. Target and Wal-Mart are exceptions – if the card giver can find the original receipt.

- Prepaid phone cards sound like a great idea, but many states exempt them from their regulations.

Consumers Union’s website lists the state regulations. But it might be easier to just put some cash in a pretty envelope or with a Christmas card.