Medicare Primer: Advantage or Medigap?

Traditional Medicare with a Medigap plan or Medicare Advantage? My Aunt Carol in Orlando wrestled with this decision for some five hours in sessions with her Medicare adviser, which she followed up with multiple phone calls – and a raft of additional questions.

“You have to ask these questions. You really have to think about it,” she said. “It’s confusing.”

Essentially every 65-year-old American enrolls in Medicare, and many get additional coverage. One form of additional coverage is through supplements to traditional Medicare, which include a Part D prescription drug plan and/or a Medigap private insurance plan to cover some or all of Medicare’s co-payments, deductibles, and other out-of-pocket costs. The other is through Medicare Advantage, a managed care option that typically provides prescription drug coverage and other services not included in the basic Medicare program.

So which to choose? Consumer choices have proliferated since private plans were added to Medicare 40 years ago. The typical beneficiary today has about 18 Medicare Advantage options, a multitude of Medigap plans for people who choose the traditional route, and 31 prescription drug programs, according to the Kaiser Family Foundation.

This primer is for new enrollees like my aunt. A future blog will provide suggestions from leading Medicare experts about ways to think about this important decision and the financial issues at stake.

The following compares the primary advantages and disadvantages of traditional Medicare and Medicare Advantage plans. But everyone is unique, and it’s impossible to simplify a process that requires each individual to research his or her best options, based on the severity of their health issues, their preferences and financial situation, and the policies available in their state’s insurance market.

Premiums

Monthly premiums are the easiest information to compare, and cash-strapped retirees too often base their decisions largely on the premium they’ll have to pay every month. But potential out-of-pocket costs, such as copays and deductibles, might ultimately prove more important, especially as retirees age and are more likely to incur high medical bills. Considering both the premiums and out-of-pocket costs complicates the choice between lower-premium Advantage plans and higher-premium Medigap plus a prescription drug option.

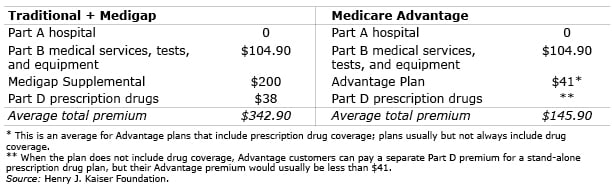

Average monthly premiums; excludes copayments, deductibles, and cost-sharing

Part A hospital coverage is free for most people, but everyone enrolled in Medicare pays the Part B premium – the base amount is $104.90 per month in 2015, but higher-income people pay more – which covers doctor visits, outpatient care, lab work, scans, medical equipment and other services.

In traditional Medicare, beneficiaries pay deductibles and co-pays, typically 20 percent for office visits and other Part B services, and the program does not limit out-of-pocket spending by beneficiaries. Medigap plans – also known as Medicare Supplemental Insurance – cover some or all copayments and deductibles, and about one-third of traditional Medicare enrollees have Medigap, according to Kaiser. Premiums average about $200 per month and can go as high as $500 and do not include prescription drug coverage. Most people who choose traditional Medicare get a Part D drug plan, which averages $38 a month.

Growing numbers of Medicare beneficiaries are flocking to Advantage plans (also known as Part C), because the additional premium for these plans, on average about $41 a month for plans with prescription drug coverage, is much lower than premiums for a supplemental Medicare Part D prescription drug plus a private Medigap plan. Advantage plans, typically offered by HMOs, limit out-of-pocket costs to $6,700 or less annually and often provide prescription drug coverage. A 2013 study by Kaiser found that the vast majority of Medicare beneficiaries have access to at least one Advantage plan in their area that includes prescription drug coverage but only half choose them.

The bottom line on premiums: the average Advantage Plan premium plus the Part B premium equals $146 per month, when prescription drug coverage is included. This is half of the $343 in total premiums a beneficiary would pay for the Part B premium, plus a Medigap and a Part D drug plan, according to Kaiser’s estimates.

Extras

Advantage plans offer additional services that can include everything from dentures and dental care to eye glasses and gym memberships – as determined by the insurance company. Advantage plans typically require no cost-sharing for preventive mammogram and prostate screenings, and some waive traditional Medicare’s requirement of a three-day hospital stay to qualify for rehabilitation in a skilled nursing facility.

Out-of-pocket costs

Advantage premiums are lower because they manage patients’ care, limit choice, and also receive government subsidies to induce retirees to enroll in these managed care plans. Medigap plans often provide more coverage of out-of-pocket costs – in exchange for higher premiums.

Traditional Medicare has deductibles and co-pays and places no limit on beneficiaries’ out-of-pocket expenses. To defray these out-of-pocket costs, 10 Medigap plan options, established by law, are currently available. Each option covers varying percentages of the Part A and Part B copayments and deductibles, ranging from 50 percent to 100 percent per service; only two (Medigap K and L) have explicit limits on annual out-of-pocket expenses. To view a chart of copayments, deductibles and plan coverage, click here and scroll to page 11. Drug plans also have their own out-of-pocket limits.

Advantage plans have deductibles and copays, which are capped at $6,700 per year. Insurers can offer plans with lower out-of-pocket maximums, but only half of Advantage plans were below the cap in 2010. The average Advantage limit was $5,014 in 2015, up 16 percent from $4,313 in 2011, according to Kaiser. The number of Advantage plans available is also declining for the typical beneficiary, according to Kaiser. Out-of-pocket costs for hospital stays vary widely, depending on the length of the stay and the type of physician network – health maintenance organizations (HMOs) are the least expensive, and preferred provider organizations (PPOs) are the most expensive – just as they are in employer health care plans. To determine the limits on Advantage plans requires digging into each individual policy. These limits, as well as the premiums, can also change from year to year; the monthly premiums are in addition to the $6,700 cap.

Medicare experts say that people who want no out-of-pocket risk should purchase a Medigap F policy, which covers 100 percent of all out-of-pocket copayments and deductibles for Parts A, B, hospice care, and even skilled nursing facility care. But it will cost them a higher premium. Medigap F has a second option with a deductible, which is $2,180 in 2015.

Physician networks

Physician access is a critical issue for people who are loyal to a longstanding primary care physician or a line-up of specialists with a deep understanding of their medical problems. Beneficiaries enrolled in traditional Medicare can see any doctor who accepts Medicare’s payment rates.

Advantage plans, like HMOs or PPOs, require patients to use the insurer’s network of doctors, labs, specialists and other services – or pay extra to see an out-of-network physician. Here’s an example of an issue that can arise: a Boston-area resident diagnosed with cancer will want access to the world’s top oncologists at the Dana Farber Cancer Institute – but Dana Farber isn’t necessarily in their Advantage plan’s network. People living in low-population areas with fewer doctors may also have more difficulty finding the right doctor under an Advantage plan. Advantage plans can also change the providers in their networks anytime during the year – not just during the open enrollment period.

When my Aunt Carol met with her benefits counselor, they looked up every one of her doctors in the Advantage plans she was considering. Her primary care physician was not in the plan she liked, which would force her to change plans, or change her doctor.

Simplicity

For many people, simplicity is an appeal of Advantage plans. The coverage – Parts A, B, sometimes D, and the extras – comes neatly wrapped in one package. In contrast, traditional Medicare coverage requires beneficiaries to keep track of their Medigap coverage and a Part D drug plan. And picking from Medigap’s alphabet soup of policy options – A, B, C, D, F, G, K, L, M, and N – can be confusing.

Re-enrollment

One advantage of traditional Medicare is that the government-set terms in Medigap policies change slowly. Advantage plan coverage, on the other hand, can change from year to year, requiring older people to “shop” every year to renew or select a new plan when the open enrollment period comes around between October 15 and December 7. Insurers can also stop selling a plan in a beneficiary’s state-regulated insurance market, forcing a retiree to find a new plan. Some Medicare experts point out that if an individual’s health deteriorates suddenly, and the new options in their Advantage plan don’t cover their needs, they must wait to purchase a new plan during the next enrollment period.

In making a decision, brand-new Medicare beneficiaries should be aware of a basic rule in their favor: they have guaranteed acceptance into any Medigap policy in their market only when they initially enroll in Medicare. Medigap insurers are, however, permitted to reject them if they start out at age 65 with an Advantage plan and then decide later to switch to traditional Medicare with a Medigap policy. Perhaps seniors have figured this out, because a Health Affairs study in January by Kaiser researcher Gretchen Jacobson found that the majority of new enrollees in Advantage plans are seniors switching over from traditional Medicare. Advantage plan enrollees who want to return to Medigap should be able to find a plan but should make sure they have a Medigap option before letting go of their Advantage plan.

Employer retiree health care

For the minority of Americans whose employer or union still offers health insurance to their retirees, the design of Medigap coverage typically complements traditional Medicare and covers copayments and deductibles.

Your local insurance market

Insurance markets are regulated by each state, and there are 50 different markets with different regulations, policy terms, and market dynamics. This creates real differences in the options available from one state to the next. Industry dynamics also drive costs. In one study, a merger of two national insurance companies resulted in premium increases of 7 percent in the typical insurance market.

If your 65th birthday is coming around soon, it’s time to get to work researching your options.

A previous blog discussed the cost of missing Medicare enrollment deadlines.

Comments are closed.

![iStock-910619648 [Converted]](https://crr.bc.edu/wp-content/uploads/2023/04/iStock-910619648-Converted-640x454.png.webp)

Is there any better example of how public policy has been captured by rent seeking?

My mother is 90 and has the health issues you might expect of someone that age (mild diabetes, worn out knee joints, limited vision in one eye). While she is not suffering from dementia or Alzheimer’s, she is not as sharp as she used to be. Choosing her own health care options – given the complexity – is out of the question. I’m 65 and have a master’s degree (which I say not to boast but to put our retirement health care system into perspective): it’s totally incomprehensible. If someone who is literate and able to deal with complexity can’t make heads or tails of the choices, costs, trade-offs, limitations, and penalties of the current system, who can? I like to joke that the U.S. has created a health care regime that successfully combines the worst elements of capitalism and socialism. But it’s no joke. Doctors waste untold man hours fighting with insurance companies, hospitals overcharge, leaving the patient/insured bewildered. What is going on? I see my own retirement as a Kafka-esque nightmare of never-ending health care paperwork until I become senile and my poor children have to figure out what to do.

This is very helpful. I see that Medicare Advantage can save you a lot over Medigap but it has a smaller network.

One thing I’m confused about. One “pro” you list for Medicare Advantage is simplicity, yet this Medicare Advantage article lists it as a con, since no two Part C plans are alike in coverage.

I would have to agree that Medicare Advantage is not simple. I’m struggling with comparing plans in my area. Each network, coverage, silver sneaker, drug plan and out-of-pocket maximum is different. Any resources for helping pick the best Medicare Advantage Plan, please!!!!!!

This is very helpful. I see that Medicare Advantage can save you a lot over Medigap but it has a smaller network.

One thing I’m confused about. One “pro” you list for Medicare Advantage is simplicity, yet this Medicare Advantage article lists it as a con, since no two Part C plans are alike in coverage.

I would have to agree that Medicare Advantage is not simple. I’m struggling with comparing plans in my area. Each network, coverage, silver sneaker, drug plan and out-of-pocket maximum is different. Any resources for helping pick the best Medicare Advantage Plan, please!!!!!!

While an interesting and informative article for the layperson, it has a few inaccuracies. It also doesn’t mention key factors driving Medicare Advantage plans and perhaps the best reasons to join one.

What ultimately matters is not monthly rates, deductibles or co-pays, which so many focus on. Instead, it should be about access to quality care. A follow up article could be: Which choice delivers better care…Original Medicare + Medigap or Medicare Advantage?

The manner in which healthcare is provided is changing quickly, driven by technology, the ACA and other public policy decisions. Advantage plans have largely led the way in this and continue to do so today.

Advantage plans are way ahead of fee for service practices in use of coordinated risk management, focus on wellness, electronic record sharing, chronic illness interventions, medication adherence and other outreach to members. Top Advantage plans today are all about using a team approach to drive better outcomes and these are just some of the ways they do this.

By comparison, those with Traditional Medicare are left to coordinate their own care, perhaps aided by a family member. For those with the time, knowledge and inclination to do so this is one way to go. But what about those who can’t? Or what happens as we get older? Managed care may actually save your life.

So you either embrace managed care as a benefit or you view it as a gatekeeper. Increasingly, especially for those new to Medicare, Advantage plans look appealing and may even easier to understand. The concepts of network providers, co-pays and caps on out-of-pocket costs is quite familiar to those coming off employer group plans.

If you still wish to cover out-of-pocket costs, consider a stand-alone hospital/short-term nursing indemnity plans…available for very reasonable cost to help offset the biggest co-pays for Advantage plans.

My biggest concern about Advantage plans is how they’ve suffered at the hands of the Federal Govt. It has been a love-hate relationship with Federal funding erratic, to say the least, driving many Advantage plans from the marketplace. Perhaps things will settle down now a bit with an 85% loss ratio now established for these plans. And certain politicians need to stop railing against these plans when they are profitable…after all, they bid on this business annually under a CMS managed process.

To be clear Margo, the Advantage plans save on premiums but the jury’s out on which plans have lower total out-of-pocket costs when deductibles and copayments are added in. I haven’t found any data comparing them but will continue to look for it.

But thanks Margo and everyone for the great comments- of course, many Squared Away readers know a lot about Medicare through experience – hope more readers share their experiences.

Please share our blog with your friends and family!

Kim (blog writer)

The Medicare Plan Finder at medicare.gov should help you whittle the list down.

The message here that the answer to this question really all depends on where you live – by county as well as by state – is very important, particularly vis a vis your ability to choose Medigap as a supplement one year and then going to Part C as a supplement the next and then back to Medigap a third year and so forth. This is very easy in some states and very hard in others because Medigap is private insurance.

But there is one easy way to make the decision process between Medicare supplement approaches simpler (and it sounds like that’s what happened with Aunt Carol). If your preferred provider or providers do not accept a public Part C health plan (many do not), and you do not want to change providers, you have no choice except Medigap.

Also the author says “many” people on Medicare “get additional coverage.” The percentage of people on Medicare who “get additional coverage” is between 90% and 100% (of people on Medicare but not on Medicaid). That’s a lot more than “many” in my opinion and I bring it up not as criticism but only because it indicates how important doing something is. Some of the other data in this article seems out of date but it all seems directionally correct except for the comment about public Medicare Part C plans (Medicare Advantage is only one type of Part C plan) offering certain screening tests with no co-pay. Traditional Medicare also covers the same screening tests with no co-pay (but traditional Medicare does not cover an annual physical exam at all).

Go to http://www.medicare.gov. You can run a side-by-side comparison (up to three plans) for any Medicare Advantage plan in your area. It will show costs, premiums, co-pays and annual out-of-pocket costs. It also includes CMS Star Ratings, an assessment of plan value, quality of care and service and other factors CMS considers important.

There is also a feature to enter your personal drug list which will furnish a separate report on what your prescriptions will run for each plan.

By law, the out-of-pocket payment is currently capped at $6,700 for Advantage plan services in-network. Plans allowing out-of-network services (PPOs, POS, etc.) can cap at up to $10,000. The $6,700 cap is typically embedded in the $10,000 figure, so not a separate deductible. Plans can cap costs at lower levels if they choose.

One thing the article didn’t point out is costs for outpatient drugs (Part D) are NOT included in the caps mentioned above. Part D has it’s own cost structure, even when the drug plan is attached to the Advantage plan.

I suggest Part C plans, at least when you compare type to type, i.e. HMO vs. HMO, PPO vs. PPO, etc. may not be as difficult as it appears to understand and compare. For one, they ARE Medicare and must provide all the same covered services as Traditional Medicare Part A and Part B.

They all must cap or limit medical costs which by law cannot be more than $6,700 currently. Plans that allow out-of-network care can adjust the cap up to $10,000 (but inclusive of the $6,700 figure).

The moving parts thus are the co-pays and you should be able to readily compare. You can run a side-by-side comparison using the search tool at http://www.medicare.gov. It also will let you compare drug costs within the plan. To get this you enter your list of drugs into the program for a report with break-out for these separately.

While Advantage plans can also provide additional services, you are better off making a choice on the health care and drug plan component, ignoring extras like free glasses or exercise classes. Extras are perhaps for a “tie breaker” all else being equal.

Key consideration to join any Medicare Advantage plan is the network of providers. Are your doctors in the plan? If not, are you willing to change providers? Also look to see if providers are Board Certified.

And don’t overlook the CMS Star Rating system with tops at 5-Stars. This gives you a good overall idea of plan value, quality of services, consumer satisfaction and what CMS considers important.

I hope this is helpful to you.

Disclosure: I’m a licensed health insurance agent serving DC, MD and VA serving the Medicare insurance marketplace.

If your area has Advantage PPO, this usually offers more choices and providers. I have found the cost and benefits better than my private corporate plan that I paid $15k/year.

You need to weigh the risk vs. total out-of-pocket. First year premium was $0.00/month, out-of-pocket total for one year was $120 for my wife and I.

My wife will still be working for a number of years after I retire. I can get coverage on her plan as a spouse which adds another vector in the consideration. Any special considerations here other than cost when comparing against Medicare standard or Medicare Advantage?

I am a SHINE counselor (serving the health insurance needs of the elderly). This is a volunteer program and we are all trained in all kinds of Medicare issues. Keep in mind that if you spend $342.90 per month ($4,114.80 for the year) it is cheaper than the Advantage PPO out-of-pocket maximum for medical care of $6,700 (does not include drug out-of-pocket payments for either type of plan).

If you are healthy, the Advantage Plans are great. But once people get sick they want to switch to the supplement and, as was indicated above, the supplement companies can turn them down and/or charge a much higher premium.

This is a very hard decision to make and the comparison for everything needs to be well thought out. There are SHINE or SHIP counselor programs in every state through the area aging offices. These counselors do not get any money and they are all highly trained volunteers. It is helpful to contact a counselor to help you make a decision and then to help you select a plan. Once you do select the plan, you will do your own enrollment as these counselors do not enroll people in any plans, including Part D plans.

An insurance agent friend of mine in a Medicare Advantage plan suffered a pretty serious heart attack in Feb. He has tracked his co-pays and thus far, they’ve barely exceeded $2,000. This has actually given him confidence in his plan. As he said it, “you have to be pretty sick puppy” to even reach this amount.”

It is perhaps human nature for some to try and switch out of a Medicare Advantage plan to return to Original Medicare with Medigap.

Medicare needs to do a better job of informing beneficiaries that there is no AEP for Medigap as there is for MAPD and PDP plans.

My opinion is that the whole concept of health care management now firmly part of Medicare Advantage plans is actually THE reason to remain enrolled in one when someone realizes they are sick and need care! This is the best reason to have such a plan in the first place, not whether the mo. plan premium was less than a Medigap plan. It is about the CARE you receive, NOT the plan premium or even the co-pays.

Back in 1992, the Feds told the state INS commissioners to clean up Medigap or they would take it over. NJ had 185 plans, all different and confusing to all, seniors as well as agents. The result was NAIC had 10 identical plans, so comparison became easy.

Then greed captured Congress, big pharma and big health insurers. So now the seniors are confused targets again. Part D law was written verbatim by the big pharma lobbyist; Part C and D allowed to have hundreds of different options, totally ignoring the message of Congress back in 1992, to simplify or else. What a difference 12 years made! Am I more pissed off as a senior or as a health agent? It is a toss-up.

Why do you say that? I don’t see where there is any guarantee from Medigap indicating that you can switch back to them in the future. There are only very specific instances where that is possible to have such a guarantee. In any case, the guarantee only lasts 12 months, unless you are moving or your Advantage plan is canceled.

What are you basing this comment on?

Jean – thanks for the question.

First, I want to be clear I’m not giving any advice – only providing information.

This is information can be found on Medicare.gov, and here’s the link! https://www.medicare.gov/supplement-other-insurance/when-can-i-buy-medigap/when-can-i-buy-medigap.html

Kim (blog writer)

As an insurance professional, quality of care and CHOICE is with Traditional Medicare with a Medicare Supplement and Part D Drug Plan, HANDS DOWN!