Medicaid Expansion Reduces Unpaid Debt

One in five Americans is burdened by unpaid medical bills that have been sent to a collection agency. Medical debt is the most common type of debt in collections.

This burden falls hardest on lower-paid people, who have little money to spare between paychecks. These are the same people the 2014 Medicaid expansion under the Affordable Care Act (ACA) was designed to help. Some 6.5 million additional low-income workers were getting insurance coverage just two years after Medicaid’s expansion, which increased the program’s income ceiling for eligibility in the states that chose to adopt the expansion.

The evidence mounts that this major policy has improved the precarious finances of vulnerable households.

The evidence mounts that this major policy has improved the precarious finances of vulnerable households.

A new study of the regions of the country with the largest percentage of low-income residents found that putting more people on Medicaid has reduced the number of unpaid bills of all kinds that go to collection agencies and cut by $1,000 the amounts that individuals had in collections.

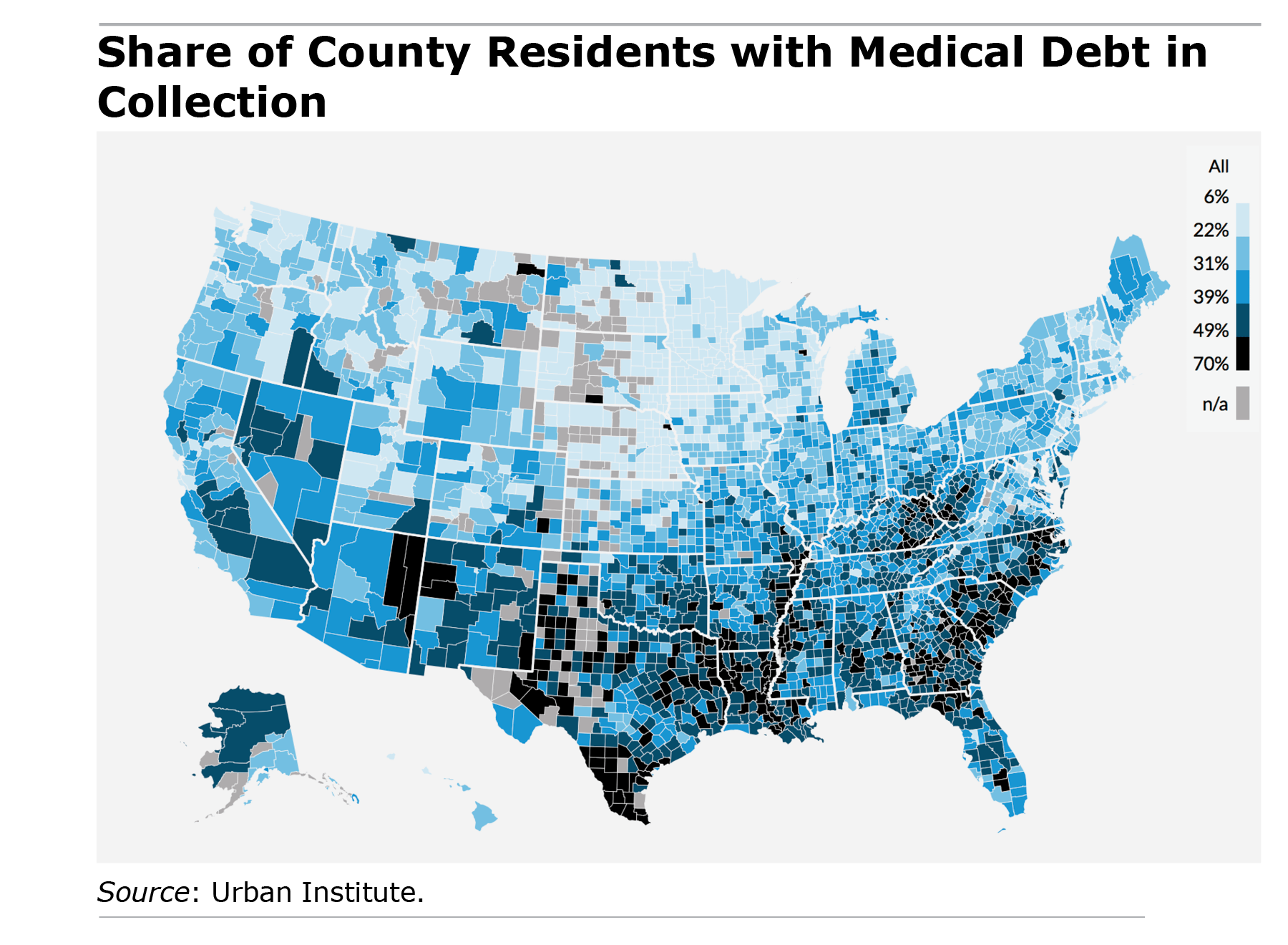

The impact in states that did not expand Medicaid is apparent in Urban Institute data. Five of the 10 states with the highest share of residents owing money for medical bills – North Carolina, South Carolina, Oklahoma, Tennessee and Texas – decided against expanding their Medicaid-covered populations under the ACA option. About one in four of their residents have medical debt in collections.

That’s in contrast to Minnesota, which has one of the most generous Medicaid programs in the country and the lowest rate of medical debt collection of any state (3 percent of residents), said Urban Institute economist Signe-Mary McKernan.

“Past due medical debt is a big problem,” she said. “When [people] have high-quality health care, it makes a difference not only in their physical health but in their financial health.”

Yet more support for this argument can be found in another Urban Institute finding: adults are better able to pay their medical bills if they have some kind of health insurance, whether Medicaid, employer, or other coverage. The study also demonstrated the importance of medical insurance by revealing a generational divide in who is able to manage their healthcare expenses. Millennials and Generation-Xers carry more medical debt than retirees, even though retirees, by definition, have poorer health and higher health care costs. The reason: Medicare, the federal government’s companion to Medicaid, covers virtually everyone over 65, McKernan said

Absent quality insurance, the immediate financial problems facing people who can’t pay their medical bills also have a negative impact for years to come. When these debts go into collections, the resulting lower credit score makes it more difficult or more expensive to get a mortgage or small-business loan, she said.

“My advice is to get health insurance even if you’re young,” McKernan said.

Squared Away writer Kim Blanton invites you to follow us on Twitter @SquaredAwayBC. To stay current on our blog, please join our free email list. You’ll receive just one email each week – with links to the two new posts for that week – when you sign up here.

Comments are closed.

What this says to me is that single payer is the only viable long-term answer. Why is the US the only economically well-developed country in which poverty due to medical expenses is a crucial issue? Read my recently-published book Prescription for Bankruptcy for a fuller discussion.

“My advice is to get health insurance even if you’re young,” – oh my god!