Jobless Boomers: How They Survive

Squared Away wrote about three unemployed baby boomers on Tuesday – an arts administrator, a corporate executive, and a social-services professional – who are having to scrounge for income to sustain themselves.

They are among the more than 1.5 million baby boomers caught in that painful limbo between a long and successful career and retirement – very possibly by default. All three want to get back into the labor force but may be forced to retire, because it’s more difficult for them to find employment than it is for younger workers.

While nearly half of unemployed adults between the ages of 25 and 49 were able to find work within seven months during and after the Great Recession, it took more than nine months for half of those over 50 to find a job, according to the Urban Institute, a Washington think tank. Many boomers may never find a job and will eventually retire.

“It’s different than being 35 or 45 and out of work,” said Kevin Milligan, an economics professor at the University of British Columbia. “We don’t necessarily expect these [older] people to go back to work.”

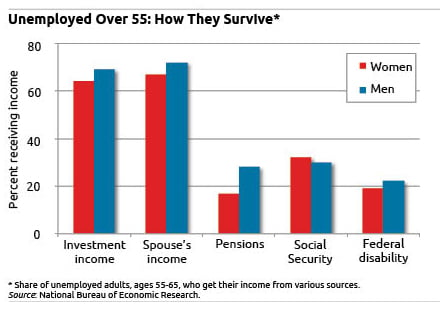

Milligan’s research last year determined that two-thirds or more of jobless Americans between ages 55 and 65 rely on their spouses for income. With only one spouse working, this creates hardships. These older households suddenly are able to save less in their 401(k)s. Milligan found that smaller numbers of boomers are also tapping their employer pensions or Social Security retirement benefits.

Milligan’s research last year determined that two-thirds or more of jobless Americans between ages 55 and 65 rely on their spouses for income. With only one spouse working, this creates hardships. These older households suddenly are able to save less in their 401(k)s. Milligan found that smaller numbers of boomers are also tapping their employer pensions or Social Security retirement benefits.

The jobless boomers who were profiled are tapping charities, teaching college courses, and collecting food stamps while they search for employment. But many unemployed boomers who are old enough to file for their Social Security benefits feel they’re being forced to do so before they had intended, sacrificing a bigger check if they could just delay filing for a few more years.

Milligan’s data also show that roughly two-thirds receive some income from their investments or savings, including capital gains, stock dividends, or yields on bank certificates of deposit. However, he said this source typically supplies very small amounts of money, and not enough to live on. That’s because the amount most boomers have saved for retirement is small. In 2010, the typical household between the ages of 55 and 64 had saved $42,000 for retirement, slightly less than their savings in 2004.

Full disclosure: The study by Kevin Milligan cited in this post was funded by a grant from the U.S. Social Security Administration (SSA) through the Retirement Research Consortium, which also funds this blog. The opinions and conclusions expressed are solely those of the blog’s author and do not represent the opinions or policy of SSA or any agency of the federal government.

Comments are closed.

I was forced into retiring at 61 and my wife is disabled. I have a part-time job that doesn’t pay enough to bring the food to the table, so we’ve had to resort to Food Stamps. We are living in housing for seniors that is too expensive to live in and eventually we’ll have to move. Moving takes money we don’t have. Formerly an Electronic Technician without a degree, I am forced into using VA rehabilitation to get a degree in another field. So we are only six months away from true poverty and homelessness.

My wife is disabled and not getting anything because her ailment is Fibromylagia and the lawyers say the system is not too sympathetic. So into poverty we go and it’s anybodies guess where we end up. Tough luck on us!

Nelson,

I was unemployed once, and I know how difficult it is. Thank you so much for sharing your story — maybe it will inspire others to do the same.

Good luck to you!

Sincerely, Kim, blog writer.

Nice read! Thank you for sharing your story. This will be a great inspiration to many as well.