Immigrant Flows Impact Social Security

Manuel Carvallo immigrated from Mexico at age 40 and became a U.S. citizen at 51. The Georgia pension consultant just reached another milestone, accumulating the 10 years of U.S. work experience required to receive a small Social Security pension when he retires.

Millions of immigrants from around the world who work here illegally could get the same opportunity as Carvallo under President Obama’s executive actions on immigration, which propose to give many of them temporary legal work papers and Social Security numbers. Great uncertainty remains about where U.S. immigration policy is heading as Congress actively seeks to reverse the president’s administrative actions

What is clear is that when undocumented immigrants – farm workers, hotel workers, and household and restaurant staff lacking green cards or other legal status – do pay into Social Security, they often have little prospect of ever receiving benefits. In 2010, some 3 million such workers with fake or expired Social Security numbers added a $12 billion bonus to the Social Security Trust Fund, the U.S. Social Security Administration estimated.

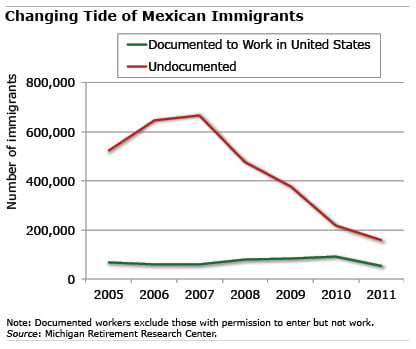

But a new study of Mexican immigration between 2005 and 2011 shows an abrupt end to what had been steady increases, year after year, in the number of these undocumented workers crossing the U.S.-Mexico border and adding to the Trust Fund.

In the wake of the Great Recession, the inflow of undocumented workers slowed sharply to about 159,000 new Mexicans migrating and seeking work in 2011, down from a 2007 peak of almost 670,000. The study was based on Mexican government surveys taken in bus depots, airports, and train stations in northern border cities.

The upshot, the authors said: “The number and dollar value of [new] Social Security contributions that cannot be attributed to a valid identity are also likely to have declined sharply.”

Meanwhile, the flows of documented workers who make numerous trips back and forth across the border increased during the same period. These immigrants are more likely to one day become eligible to collect Social Security pensions.

It’s impossible to predict how these trends will develop amid a strengthening U.S. job market and divisions over immigration policy. But as the researchers noted, it’s an interesting trend that bears watching.

The research reported herein was performed pursuant to a grant from the U.S. Social Security Administration (SSA) funded as part of the Retirement Research Consortium. The opinions and conclusions expressed are solely those of the author(s) and do not represent the opinions or policy of SSA or any agency of the federal government. Neither the United States Government nor any agency thereof, nor any of their employees, makes any warranty, express or implied, or assumes any legal liability or responsibility for the accuracy, completeness, or usefulness of the contents of this report. Reference herein to any specific commercial product, process or service by trade name, trademark, manufacturer, or otherwise does not necessarily constitute or imply endorsement, recommendation or favoring by the United States Government or any agency thereof.

Comments are closed.

If $12 billion is the estimated bonus for 2010, what is the accumulate effect in the Social Security Trust Fund?

This is true. But there are also a significant number of undocumented immigrants collecting Social Security and other benefits via identity theft. What is the offset point?