Gen-X Retiree Income Inequality to Widen

There’s a growing awareness of the chasm between average working Americans and those at the top of the earnings scale.

What isn’t widely recognized is that this broad economic trend is spilling over into retirement incomes, which depend on how much people earn and save while they’re still working.

“The increasing wage inequality we see during the working years plays out over the life course and will result in more unequal incomes at older ages,” said Richard Johnson, an economist with the Urban Institute in Washington.

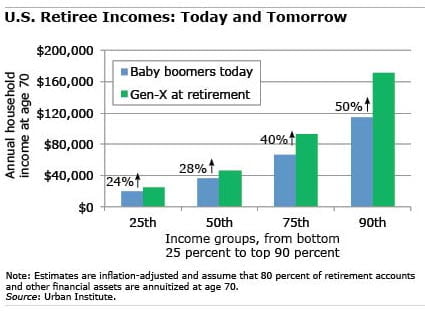

Johnson recently compared the incomes of today’s retirees with his income projections for the youngest members of Generation X who will enter retirement in about 30 years. He found that the imbalance between those at the top and bottom is expected to be wider for Gen-X.

In his study, retiree income includes Social Security benefits, pensions from traditional defined benefit plans, and employment earnings. Johnson also assumes that people spend down their 401(k)s, but he does not include equity in one’s home, which retirees can also convert to income.

Johnson assumes that average workers’ wages will grow just over 1 percent per year, but top earners will do much better and the bottom not as well. He projects that Gen-X retirees in the top 10 percent will have future incomes that are 50 percent higher than similarly well-heeled retirees today – $172,000 for Gen-X in today’s dollars, compared with $114,500 currently.

But for retirees in the bottom quarter of the income scale, retirement incomes for Gen-X will be just 24 percent higher than the incomes of current retirees in the low-income bracket – $25,000 for Gen X, vs. $19,800 today.

Social Security benefits temper inequality, because they replace a larger share of the earnings of low-paid workers than they do for corporate executives. Despite this leavening effect, Johnson expects the following factors to widen the income disparity:

- The wage replacement rate for Social Security is declining.

- Fewer workers over time are covered by traditional defined benefit pensions, which are being replaced by 401(k)s.

- Those with higher earnings during their working years save more and have larger balances in their 401(k) retirement accounts.

- High earners tend to be healthier and work in less physically demanding jobs, and they retire later.

- Because they delay retiring, they’ll receive higher monthly Social Security benefits, and their savings will provide more retirement income, as they have more time to grow, over a shorter period of time in retirement.