Future ‘Retirees’ Plan to Work

Most people used to sign up for Social Security when they were fairly young – around 62, which is the earliest age allowed. Not today: fewer than 40 percent are filing for benefits at that age.

So what else are we doing differently? Well, working in retirement is high on the list.

So what else are we doing differently? Well, working in retirement is high on the list.

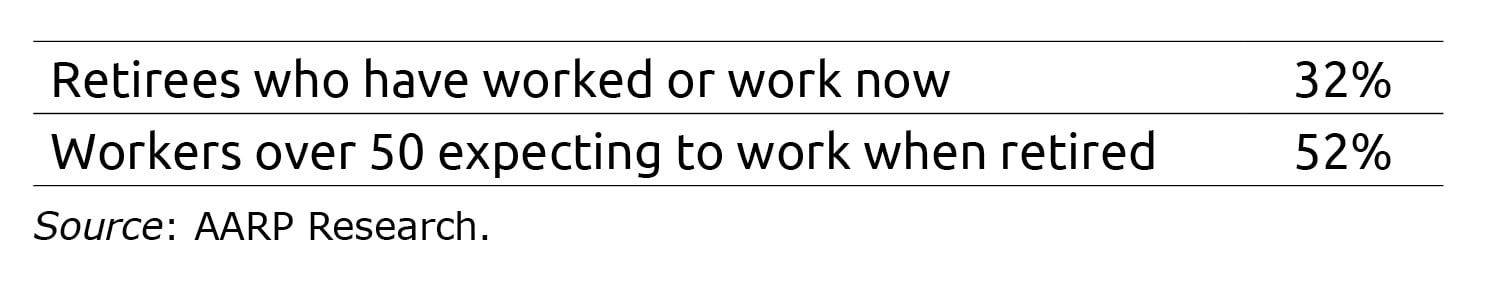

About one in three Americans calling themselves retired in a new AARP survey have worked or now work in part-time, seasonal and sporadic jobs or sometimes full-time.

Keeping in mind that people don’t always do what they’d planned, boomers’ expectations for work exceed what current retirees are doing. Well over half of workers over 50 plan to find some kind of work after they retire.

The seeming oxymoron – working “retirees” – plays out in various ways. State and local government workers retire as early as their 50s if they’ve worked enough years to max out their pensions. Some of these civil servants find other jobs while collecting a pension. Boomers who’ve left career jobs but lack a pension cut back to part-time work in their field or find a full- or part-time job in a new field.

Money is a major reason, with a notable exception. Some people work into their late 60s or 70s because they just enjoy it. They’re usually the most educated and frequently see their jobs as a labor of love that sustains their personal growth, professional identities, or relationships.

But the AARP survey indicates that most older workers think they’ll work because they need more income to meet essential needs, particularly medical care. Recreational expenses like travel will take the hit – hence a need to earn some mad money.

Low retirement savings now is behind many boomer workers’ worries about a future cash shortage. In the most extreme cases, three in 10 have saved less than $25,000 and described their financial condition as “fair” or “poor” in AARP’s survey.

Savings increase as incomes rise, and the typical older worker with a 401(k) is somewhat better off, though not in great shape, having saved about $135,000 in 401(k)s and IRAs combined. That works out to around $600 in monthly retirement income.

AARP’s findings jibe with formal research estimating future retirement income, which shows that about 44 percent of the youngest boomers – workers in their 50s – risk not having enough.

Planning is not boomers’ strong point either. Half or fewer are analyzing how much total income they can expect as retirees, how much they should be saving, or how much their medical expenses will be. One thing they do spend time on is looking up their future Social Security statements, which are easily found online.

A paltry 14 percent of baby boomers have put together a formal financial review for retirement.

Better get to work!

Squared Away writer Kim Blanton invites you to follow us on Twitter @SquaredAwayBC. To stay current on our blog, please join our free email list. You’ll receive just one email each week – with links to the two new posts for that week – when you sign up here.

Comments are closed.

I am not sure how $135,000 in retirement plan savings results in an income of $600 per month. That is a pretty high rate of withdrawal and/or investment return. What were the assumptions?

The one obstacle for older employees seeking to work longer is many employers don’t want older employees… they have the highest total compensation of any employees and are the most likely to have serious costly medical problems.

Retirees working full time? I know some people like that at work.

Seriously, an aging workforce is nothing to celebrate.

I would like to say again, “working in retirement” is an oxymoron. If you are working, you are working. If you move to a lower-paid, less-demanding job, as some do, there needs to be a word for that.

Those of us born after 1957 or so, unless they were public employees, didn’t get a long career in one thing to “retire” from. No gold watch and, of course, no pension or retiree health insurance. So “working in retirement” is just another job.

“Many employers don’t want older employees… they have the highest total compensation of any employees and are the most likely to have serious costly medical problems.”

That’s partly an employer attitude problem. They need to find a way to take advantage of this labor force. After 55, your productivity drops, but it doesn’t drop to zero.

And partly an employee attitude. One shouldn’t expect to be paid as much as when they were able to do more work.

And partly a social problem. Labor force participation has been going down from 55 to 64, and up from 65 and over. Why? The government pays for the health insurance of those 65 and over. By sticking with employment-linked health care, Obamacare maintained a system that discourages entrepreneurship (got to keep the employer group health care), hiring older workers, and hiring workers with health problems. They want to roll it back. It didn’t go far enough.

I’m 64 and was recently offered all 3 jobs to which I applied. Having more experience than other applicants, I required less training and supervision than other potential employees. I probably do have higher medical costs than younger people, but they are certainly not exorbitant: I’m healthy, active, and eat well. I show up at work every day and help (and eventually mentor) less experienced colleagues. I’m more efficient and productive. I expect to work for 5-8 more years.

I think we could celebrate.

The $600 of income per month on $135,000 in retirement plan savings is representative of the current payout rate available for a single premium immediate annuity purchased on the joint lives of a couple (male and female) who are both age 65. The effective payout rate is ~5.3%. Payments on this joint life annuity would continue until both of the purchasers die, at which point the payments would cease with no residual value for beneficiaries or heirs of the couple’s estate.

People wanting to continue working is worth celebrating.

I am 69 yrs old with full time job, including traveling for 25%. My strategy is to ask for extra vacation, even if needing to take a bit of pay cut. [Can’t envision doing ‘vacation travel’ all year!]

If something works for you, do it.

The real truth is a lot of future retirees are waiting for the federal government to offer the $40,000.00 buyout/early out that was approved last year for all agencies. If they would just offer the buyout, a lot of retirees would be out the door. Why don’t you do a survey or an article on why that has not happened?? My guess is the budget doesn’t have the money to offer it or unless our President gets his wall, there will be no buyout offer!!

Financially I don’t have to work, but I am one of those people that you mention who works simply because I like it, enjoy the challenge, and like feeling productive. I did retire from my profession as an Air Traffic Controller in 2011 and have been reinventing myself as a photographer, travel writer and permanent expat.

I enjoyed my life in the United States, but I longed for more and I have certainly found it!

My concern is the switch to the high figure salary by Congress. So, that would be the basis for working longer — to get a larger retirement check — esp. if you make $100,000 a year or more. I have 3 more yrs to go to make 30 yrs, right now I’m 53. Maybe I should wait until 60 yrs of age.

Dear Glenn – here are a couple blogs regarding your comments:

1. 62 is the minimum age to start Social Security benefits, but it’s so much better to wait. Your monthly benefit will increase about 7-8% for every year of delay: http://squaredawayblog.bc.edu/squared-away/getting-what-you-need-for-retirement/

2. Most boomers can boost their monthly checks by working longer – but 35 years’ work is appreciably better than 30: http://squaredawayblog.bc.edu/squared-away/your-social-security-35-years-of-work/

Luckily, you have lots of time to retirement!

Kim

Dear Glenn – here are a couple blogs regarding your comments:

1. 62 is the minimum age to start Social Security benefits, but it’s so much better to wait. Your monthly benefit will increase about 7-8% for every year of delay: http://squaredawayblog.bc.edu/squared-away/getting-what-you-need-for-retirement/

2. Most boomers can boost their monthly checks by working longer – but 35 years’ work is appreciably better than 30: http://squaredawayblog.bc.edu/squared-away/your-social-security-35-years-of-work/

Luckily, you have lots of time to retirement!

Kim

This is an unfortunate scenario for the boomers and would be the same for the next generation if they haven’t learned anything from this generation. Working longer makes more sense these days because some demands or expenses require stable cash flow. Retirees need more financial resources especially if they have a lot of medical needs. Medicare, even with the help of Medicare Supplement plan, might be insufficient to provide them assistance in paying their health care needs. Working way past their retirement is one of their hopes to fill some of their financial needs, and I am hoping that they like their jobs because they are staying way more than what they expect. Besides, some employers provide medical coverage, aside from having Medicare, which is one thing.

I continue to work for myself after retiring from civil service. I plan to until the end. And why not? Most older retirees I see in my community remind me of the Tin Man in the Wizard of Oz. They quit moving and rusted in place.

Should we hire a financial adviser? Some people are do-it-self, which is fine if you’re organized and comfortable with numbers. But our financial life can sometimes be complicated, and so we shouldn’t be afraid to admit that we might not have the best answers and could use some professional help.