LATEST

Topics

A common refrain among retirement researchers is that longer careers are the best way to ensure an adequate retirement. This refrain is often directed at the workers themselves – “you need to work longer!” And that message seems to have been getting through. Since the 1990s, the labor force participation rates of older individuals hav…

Since fiscal year 2019, financial markets have been jostled by a series of unusual events: 1) the onset of COVID; 2) the subsequent COVID stimulus; 3) declining interest rates; 4) rising inflation; and then 5) rising interest rates. Despite the volatility of asset values over this period, the 2023 funded status of state and loca…

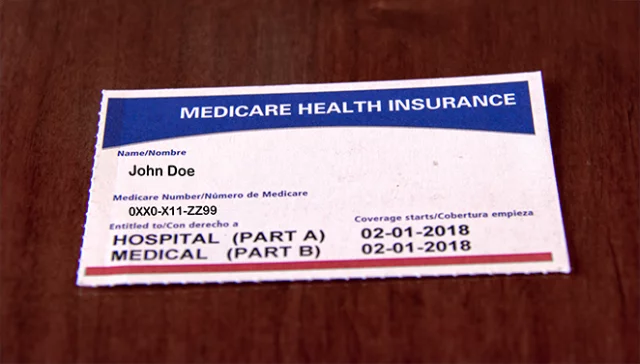

The headlines from the 2023 Medicare Trustees Report were that the Hospital Insurance (HI) program faces a long-term deficit and will deplete its trust fund reserves in 2031 and that the rest of the Medicare program will require increasing amounts of general revenues. While true, the outlook for program costs is considerably more favorable than…

CRR IN THE NEWS

NEW YORK TIMES

When it came to housing, Susan Apel and Keith Irwin thought they had planned adroitly for later life.

FEATURED

NOW ACCEPTING APPLICATIONS

Grants for a junior or non-tenured scholar and a Ph.D. candidate to pursue research on retirement or disability policy. Read the guidelines and apply online through April 30, 2024…

CRR PARTNERSHIP PROGRAM

Partnership with the Center for Retirement Research provides instant access to valuable, independent research. In building a relationship with its supporters, the Center seeks to gain their perspective on retirement income issues and to secure data to advance the goals of the Center’s research programs. The Partnership Program offers the following benefits: One presentation a…

PARTNERSHIP WITH JACKSON NATIONAL

This initiative identifies the major risks that people face as they approach retirement, seeks to understand their perceptions of those risks, measures the potential harm from the risks, and evaluates ways to mitigate them. These risks include: longevity, inflation, health, market, family, and policy. The CRR gratefully acknowledges Jackson National Life Insurance Company for supporting…

RETIREMENT PLAN ACCESS

The main reason that U.S. workers end up with inadequate retirement savings is that, at any given time, only about half of private sector workers are covered by an employer-sponsored retirement plan (see Figure 1)…

Our winter newsletter features new research on the insurance value of Social Security and new data on 401k/IRA holdings. It also announces our 2024 research grant opportunities…